Day: June 27, 2024

Why is a comprehensive stabilisation plan that goes one step beyond a zero deficit / zero money-printing commitment needed in Argentina?

By Ernesto Talvi and Sofía Harguindeguy

The hardest part of the stabilisation plan has already been carried out: a;major fiscal adjustment. It would be a sin not to capitalise on the enormous sacrifice that has been asked of citizens. However, the fiscal adjustment, which is the basis of the zero fiscal deficit / zero money-printing mantra, is a necessary but not sufficient condition to anchor and align market expectations with government policy objectives. To achieve this, it is necessary to complement the zero fiscal deficit / zero money-printing commitment with a comprehensive stabilisation plan.

Analysis

Javier Milei took office as President on 10 December 2023, with a commitment to transform Argentina. And he has taken it seriously. Among the transformations that his government proposes is, first and foremost, eliminating the fiscal deficit –primarily through reducing public spending– and stopping the financing of the treasury by printing Central Bank money, with the aim of eradicating inflation.

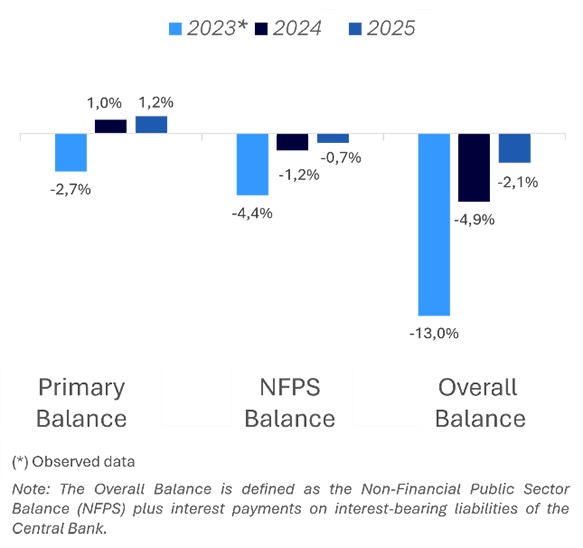

If we look at the raw numbers (and ignore the quality of the fiscal adjustment), Milei has delivered. After closing the year 2023 with a deficit of the non-financial public sector (NFPS) of 4.4% of GDP, in the first quarter of 2024 the NFPS recorded a fiscal surplus, the first Argentina has seen since 2008.

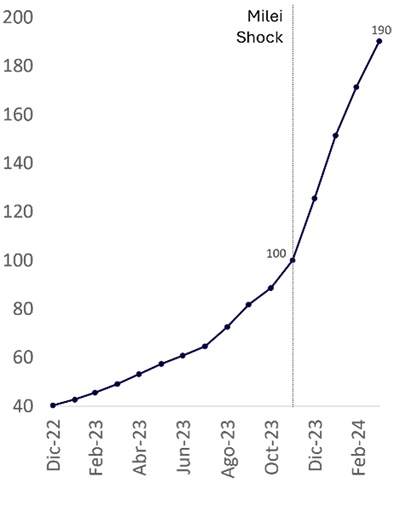

The overall fiscal deficit, which includes the interest paid on the interest-bearing liabilities of the Central Bank of Argentina (BCRA), closed the year 2023 at 13% of GDP and shrunk to a third in the first quarter of 2024 compared to the same period of the previous year (see Figure 1).

Figure 1. Fiscal balance (Pesos mn, November 2023)

Source: based on data from the BCRA, Ministry of Finance and INDEC.

Source: based on data from the BCRA, Ministry of Finance and INDEC.

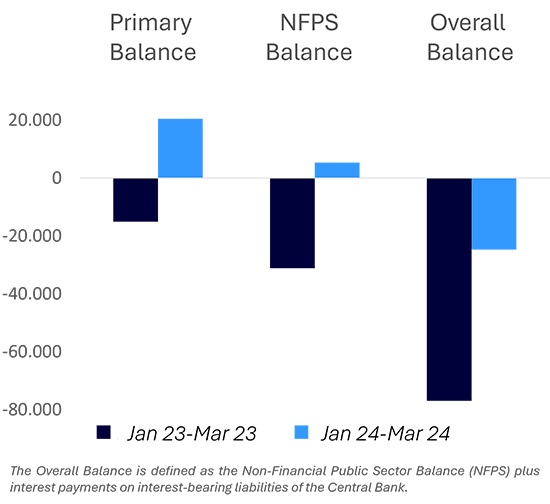

In the first quarter, Milei also fulfilled his promise of zero money printing to finance the public sector. Due to the fiscal surplus, it was not only unnecessary to print money to finance the NFPS, but the public sector withdrew pesos from circulation. The interest-bearing liabilities of the BCRA were not a source of monetary expansion in the first quarter either, since the amount of interest-bearing liabilities issued by the BCRA exceeded amounts coming due plus interest. The only exception to the zero-money printing policy was the purchase of international reserves, which, in a context where the parallel exchange rate (blue) remained flat, indicates that this injection of liquidity by the BCRA was demanded by a market eager for liquidity in national currency (see Figure 2).

Figure 2. Monetary base expansion sources (cumulative variation in Pesos mn)

Source: based on data from the BCRA, Ministry of Finance and INDEC.

Source: based on data from the BCRA, Ministry of Finance and INDEC.

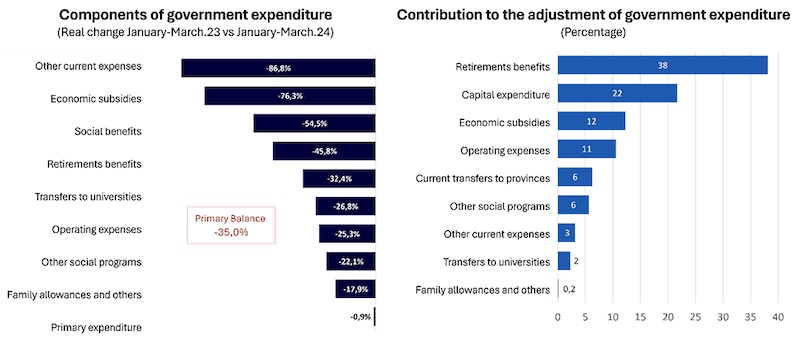

1. Anatomy of the primary fiscal adjustment of the NFPS

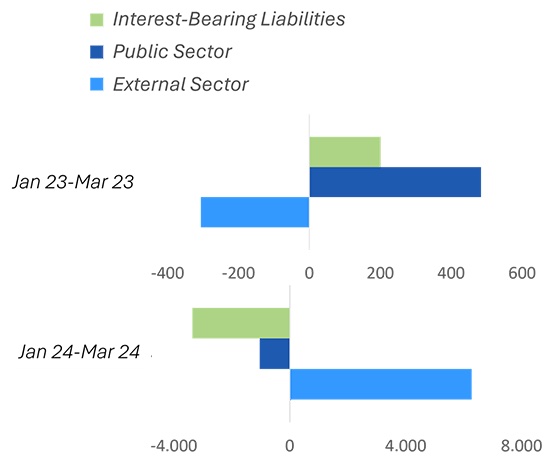

The fiscal surplus of the NFPS in the first quarter was achieved despite facing a double challenge: a real decline of 4.4% in revenues compared with the first quarter of the previous year due to the economic contraction, and a real increase of 5% in interest payments (see Figure 3).

Figure 3. Anatomy of the fiscal adjustment (real change January-March 2024 vs January-March 2023)

Source: based on data from the BCRA, Ministry of Finance and INDEC.

Source: based on data from the BCRA, Ministry of Finance and INDEC.

The key to achieving this result was a drastic reduction in primary expenditure, which in the first quarter fell by 35% in real terms compared with the first quarter of 2023. This adjustment was concentrated in five items with a very high impact on the outcome: retirement benefits and other social assistance programmes, wages, capital expenditures, transfers to provinces and economic subsidies (see Figure 4).

Figure 4. Anatomy of government expenditure adjustment

Source: based on data from the Ministry of Finance, INDEC and Infobae.

Source: based on data from the Ministry of Finance, INDEC and Infobae.

1.1. How was such a major fiscal adjustment achieved in such a short period of time?

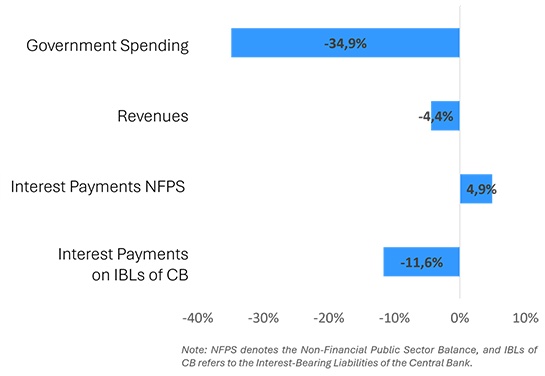

The adjustment was clearly achieved through the jump in the PRICE level of almost 100% that occurred between December and March 2024, as a result of the devaluation of the official exchange rate, the sharp increase in prices of public utilities, and the liberalisation of some controlled prices such as rents and prepaid health plans (see Figure 5). Despite this dramatic increase in the price level, most primary expenditure categories did not experience equivalent increases.

Figure 5. Jump in the price level (CPI, November 2023 = 100)

Much has been debated;about how much of the real decrease in primary spending was due to ‘dilution effect’ (due to the increase in the price level) and how much to actual cuts (the so-called ‘chainsaw effect’). What is evident is that, without the enormous jump in the price level, the observed reductions in real primary spending would have been unfeasible to implement through traditional budgetary means.

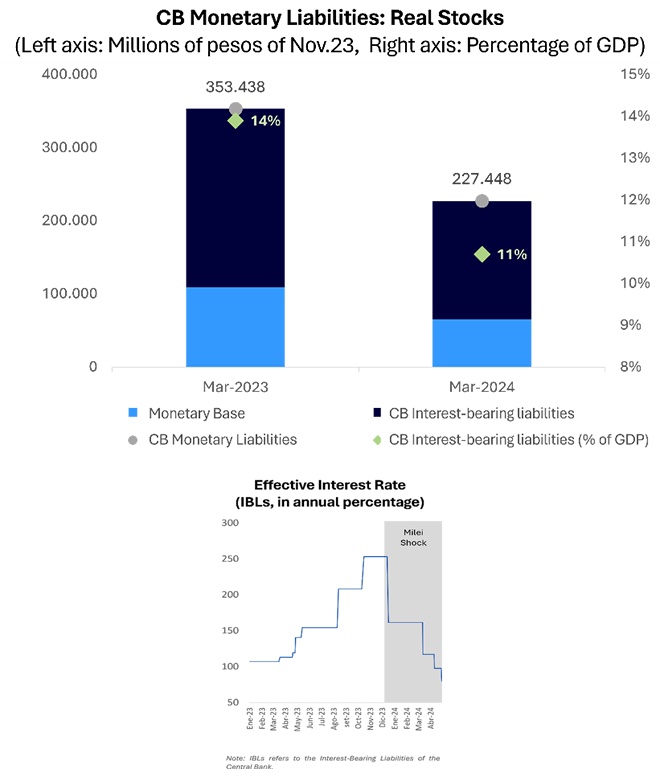

2. Anatomy of the adjustment of BCRA’s quasi-fiscal deficit

The jump in the price level not only enabled a massive fiscal adjustment of the NFPS in a very short period of time but also resulted in a very significant reduction of the quasi-fiscal deficit. The interest that the BCRA pays on its interest-bearing-liabilities decreased by 12% in real terms in the first quarter of the year compared to the first quarter of the previous year.

This decrease is due to the dual effect of the dilution of the BCRA’s monetary liabilities –which fell by 36% in real terms in the first quarter– and a very significant reduction in the interest rate on interest-bearing-liabilities, which decreased from 133% a year when Milei took office to 40% currently.

Figure 6. CB monetary liabilities and interest rate

Source: based on data from the BCRA, Ministry of Finance and INDEC.

Source: based on data from the BCRA, Ministry of Finance and INDEC.

As argued in our previous diagnostic work on the Argentine stabilisation plan,;Raising prices to lower inflation: unravelling Argentina’s economic maze, the dilution of the BCRA’s interest-bearing liabilities and the reduction of the interest rate that the BCRA pays on those liabilities are closely linked.

The doubling in the price level led to a dilution of the real value of the BCRA’s monetary liabilities, creating a situation of strong illiquidity in domestic currency. This illiquidity can be observed in the dramatic jump in the spread between the interest rate that banks charge for personal loans and the rate on the BCRA’s interest-bearing liabilities (a measure of the opportunity cost of liquidity), from an average of 2 percentage points (200 basis points) in November 2023, to an average of 33 percentage points (3,300 basis points) between December and April 2024. This situation of illiquidity in the national currency not only led the markets to sell US dollars to the BCRA to obtain pesos (which explains the significant increase in international reserves and a flat blue exchange rate) but also enabled the BCRA to issue (its now scarce) national currency liquidity at substantially lower rates.

Figure 7. Liquidity index in financial markets (personal loan rate minus interest rate on CB IBLs, in %)

Source: based on data from the BCRA.

Source: based on data from the BCRA.

3. Credibility and expectations: the Gordian Knot of the stabilisation programme

Milei delivered. And despite draconian adjustments in wages, pensions, other social benefits and transfers to provinces, for now he still retains his political capital. Inflation has been on a sharp and rapid decline, and month after month has been below market expectations.

However, the markets seem not to fully believe in the zero deficit / zero money-printing commitment (a commandment of almost biblical proportions for President Milei) and, consequently, in the eradication of inflation.

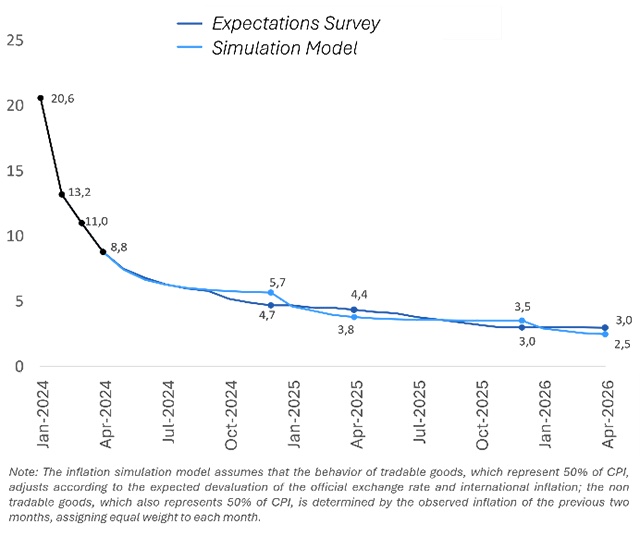

Indeed, according to the Market Expectations Survey (REM) of April 2024, while the markets expect a substantial reduction in inflation in 2025 compared with 2024 –expecting it to drop from 161% to 50%– it is far from the total eradication goal, that is, a single-digit inflation rate aligned with international inflation (see Figure 8).

Figure 8. Inflation expectations (Central Bank expectations survey, monthly variation)

Source: the authors based on data from the BCRA’s April Expectations Survey.

Source: the authors based on data from the BCRA’s April Expectations Survey.

Why are inflation expectations not yet firmly anchored? We consider three hypotheses whose analysis allows us to clearly infer the direction the Argentine stabilisation plan should take to align market expectations with government policy objectives.

3.1. First hypothesis: inflation inertia and adjustment in public utilities prices

One hypothesis to explain the persistence of high inflation at the end of 2025 is that of inflation inertia and the pending adjustment of public utilities prices to eliminate the backlog advanced by the previous government (which we estimate at 35%).[1] According to this hypothesis, inflation inertia and the expected catching up of public utilities prices contribute to keeping expected inflation above what would be justified by fiscal and monetary fundamentals.

To test this hypothesis, we built a simulation model of monthly inflation with very simple assumptions about the price formation process: the price of tradables (which we assumed account for 50% of the CPI) evolves with the expected devaluation rate of the official exchange rate and international inflation, the price of non-tradables (which we assumed account for other 50% of the CPI) evolves according to the inflation recorded in the previous two months (each month with equal weight). It is interesting to note that the monthly inflation projection for 2024 and 2025 made with this simple model is very similar to that arising from actual market expectations (see Figure 8).

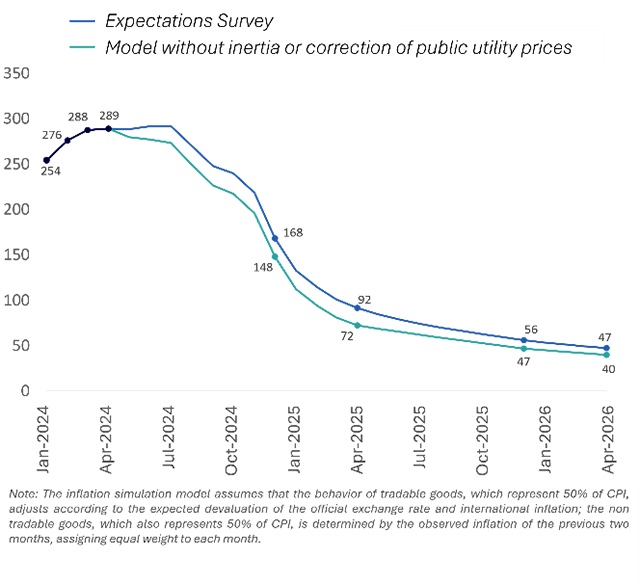

The results of this exercise are illustrated in Figure 9. Inflation inertia and the elimination of the backlog in public utilities prices are not enough to explain the non-convergence of inflation to single-digit levels in 2025. Even after purging market inflation expectations of these two factors, the expected inflation for 2025 would remain above 40% (see Figure 9).

Figure 9. Inflation expectations: the role of Inflation inertia and the correction of public utilities prices (simulation model projections, year-on-year change)

Source: the authors based on data from the BCRA’s April Expectations Survey.

Source: the authors based on data from the BCRA’s April Expectations Survey.

3.2. Second hypothesis: unsustainable fiscal adjustment

A second hypothesis is that the fiscal adjustment and the promise of zero deficit-zero money printing are not credible. The argument goes something like this: the real decrease in pensions and wages, other social benefits, capital expenditures and transfers to the provinces, are not socially, economically or politically sustainable. According to this hypothesis, the government will eventually have to yield to pressures and will need to backtrack on the fiscal adjustment made through the dilution of nominal commitments. The resulting deterioration of the fiscal deficit will have to be financed by the BCRA with money printing and inflation, and the expectations for 2025 are simply reflecting this fact.

However, according to the REM, the markets expect a primary surplus of 1% of GDP in 2024 and an even larger surplus of 1.3% of GDP in 2025. Nothing then suggests that the markets expect a reversal of the fiscal adjustment achieved, as we have seen, primarily through the dilution of primary expenditures. Moreover, the fiscal package currently being negotiated in Congress will provide additional resources that make the fiscal adjustment more sustainable over time, as it will allow the government to partially relax the steep declines in primary spending.

The expected outcome for the NFPS in 2025 is consistent with expectations about the primary balance: a deficit in the NFPS of less than 1% of GDP in 2025 that can comfortably be financed with seigniorage (see Figure 10).

Figure 10. Fiscal balance market projections (Central Bank expectations survey)

Source: the authors based on data from the BCRA and the Ministry of Finance.

Source: the authors based on data from the BCRA and the Ministry of Finance.

3.3. Third hypothesis: devaluation expectations not aligned with official guidelines

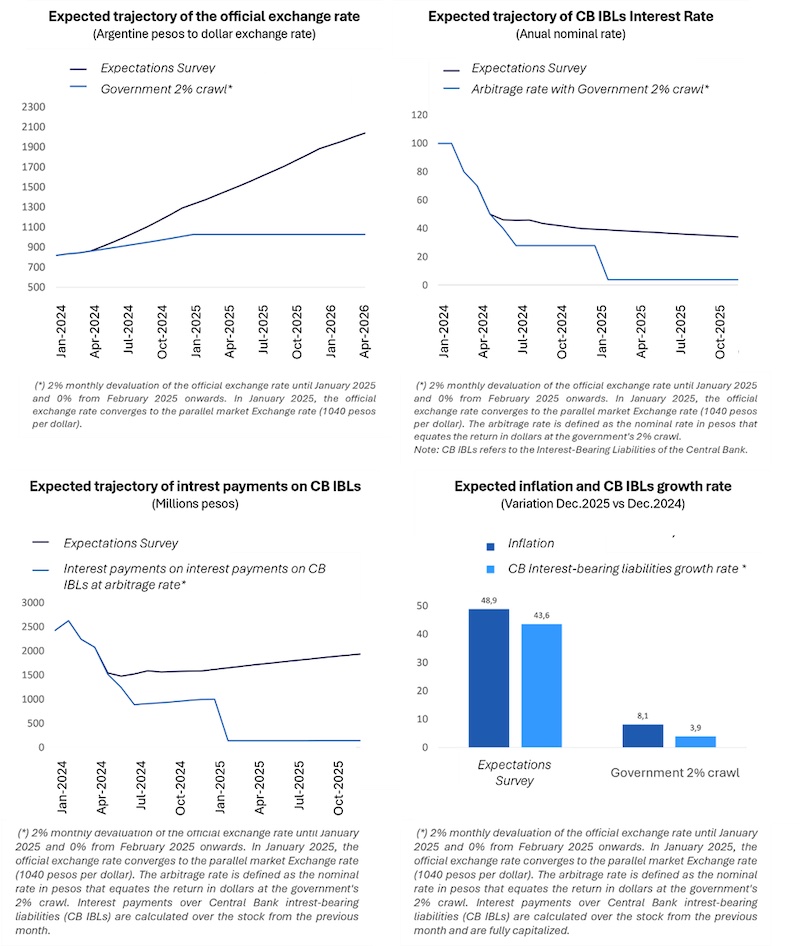

A third hypothesis, which we consider key, relates to the divorce between the government’s announced monthly devaluation guidelines and market expectations.

As shown in Figure 11, the trajectory of the official exchange rate expected by the markets differs notably from the government’s announced 2% monthly devaluation. If the 2% monthly devaluation pace were maintained, the official exchange rate would converge to the current blue dollar value (1,040 pesos per US dollar at the time of writing) by January 2025. If from that point on, the pre-announced monthly devaluation pace of the official exchange rate were reduced to 0%, the US dollar value expected by the markets by the end of 2025 (2,000 pesos per US dollar) would be double that implied by the government’s announcements and the strategy.

The evolution of devaluation of the official exchange rate expected by the markets is closely linked to interest rate expectations on interest-bearing liabilities. According to REM projections, the interest rate that the BCRA must pay on its interest-bearing liabilities will remain at 40% in 2024 and will only drop very gradually throughout 2025 to 34% (see Figure 11).

If the BCRA capitalises the total interest payments to avoid monetising them –a quite realistic assumption–, the interest-bearing-liabilities would grow at a rate of 44% in 2025, very similar to the inflation rate of 49% that markets expect for 2025 according to the REM.

In other terms, if markets expect a higher devaluation rate than the government’s guidelines and demand higher interest rates on interest-bearing liabilities, the BCRA will be forced to issue interest-bearing liabilities at a pace that ends up validating the market’s inflation expectations. Thus, it could become a self-fulfilling prophecy.

If, on the other hand, the markets were to expect a single-digit devaluation rate for 2025, the interest rate on interest-bearing liabilities would also converge to single digits, leading to a drastic fall in both interest payments and the growth rate of interest-bearing liabilities.

We illustrate this case in Figure 11, where we assume that the government maintains a 2% monthly devaluation guideline of the official exchange rate until it converges with the current blue dollar value in January 2025, and from that point on, the monthly devaluation pace of the official exchange rate is reduced to 0%. Under these conditions and according to our simulation model, the growth rate of interest-bearing liabilities in 2025 would reach a single-digit level, as would inflation.

According to this hypothesis, credibility plays a central role: what the markets expect could happen has a high probability of materialising. Of becoming a self-fulfilling prophecy. And even if it does not happen, the lack of convergence between government announcements and market expectations would make the transition unnecessarily costly in terms of a larger loss of competitiveness, a sharper contraction in economic activity, employment, and wages.

The Gordian Knot of the success of the plan thus lies in doing ‘whatever it takes’ to align market expectations with government’s guidelines. And for this to happen, a comprehensive stabilisation plan is needed to anchor market expectations.

Figure 11. Expectations of devaluation and Central Bank quasi-fiscal deficit

Source: the authors based on data from the BCRA’s April Expectations Survey.

Source: the authors based on data from the BCRA’s April Expectations Survey.

4. Towards a comprehensive stabilisation plan

The hardest part has already been done: a massive fiscal adjustment. It would be a sin not to capitalise on the enormous sacrifice that has been asked of citizens. However, the fiscal adjustment that is the basis of the zero fiscal deficit-zero money printing mantra is a necessary but not sufficient condition to anchor and align market expectations with government policy objectives. To achieve this, it is necessary to complement the zero deficit / zero money-printing commitment to finance the public sector, with several additional elements:

- Clearly define the monetary regime that the government intends to converge to (a bi-monetary economy, dollarisation?).

- Establish a nominal monetary or exchange anchor (the one that will govern the transition to price stability and the destination nominal anchor) that is consistent with the monetary regime defined in the previous point (exchange rate guidelines, monetary targets, inflation targets?) and that follows a trajectory consistent with the new fiscal and quasi-fiscal reality post dilution and adjustment.

- Remove exchange controls (although more gradually for short-term capital movements).

- De-index the economy, adjusting public wage increases, pensions, and public utilities prices based on projected inflation in the stabilisation plan.

- Lift administrative measures that distort the efficient functioning of the price system to unlock investment in key sectors of the economy.

A programme that contains all these elements, in addition to the massive fiscal adjustment already made and other initiatives –in parallel to the stabilisation plan– to carry out structural reforms, would be a programme that the IMF cannot (and should not) reject. A new agreement with the IMF would serve as a framework for the programme, provide the fresh funds needed to strengthen the BCRA’s international reserves position, and give a crucial and definitive boost to underpin credibility and ensure the success of the stabilisation plan.

Conclusions

The table is set to launch a comprehensive stabilisation programme that aligns market expectations with government policy objectives.

The hardest part has already been done: a huge and painful fiscal adjustment. Regardless of what one thinks about the quality of the adjustment made so far, the fact is that it has been done. And at a huge cost in terms of economic, household incomes and an increase in poverty. It would be a sin not to capitalise on the gigantic effort that has been asked of citizens to deliver a knockout blow to inflation in Argentina. If achieved, it would be a historic change. And it would change history.

About the authors:

- Ernesto Talvi is Senior Analyst at the Elcano Royal Institute. He has been Director of the Economic and Social Policy in Latin America Initiative at Brookings Institution in Washington D.C.; Tinker Visiting Professor at Columbia University in New York; Founding Member of the Latin American Committee for Macroeconomic & Financial Affairs (CLAAF); Director of the Center for the Study of Economic & Social Affairs (CERES) in Montevideo, Uruguay; and Chief Economist at the Central Bank of Uruguay.

- Sofía Harguindeguy is Manager of the Economic Advisory Team at Grant Thornton Uruguay. She specializes in quantitative research methods for decision making, and antitrust.

Source: This article was published by Elcano Royal Institute

[1] The 35% difference compares the current real level of public utilities prices with those of 2017, the last year in which SOEs had an operating surplus.

This year marks half a century since Aleksandr Solzhenitsyn’s;The Gulag Archipelago: An Experiment in Literary Investigation;appeared in English. Northwestern University professor Gary Saul Morson calls this work “the masterpiece of our time,” and there’s a backstory here.

After visiting the Soviet Union in 1919, California journalist Lincoln Steffens proclaimed, “I have seen the future and it works,” a claim repeated by many Western luminaries during the 1930s, as Malcolm Muggeridge recalled in;Chronicles of Wasted Time. Solzhenitsyn showed how the USSR didn’t work, except as a vast prison camp, and confirmed that the first Communist state was much worse than anybody imagined. In some quarters, the revelations did not receive a warm welcome.

While the courageous Solzhenitsyn was being hailed around the world, U.S. President Gerald Ford;declined to meet with the author. During an October 1976 debate, Ford proclaimed “there is no Soviet domination of Eastern Europe, and there never will be under a Ford administration.” As this confirmed, ignorance and reality dysphoria are not new problems in America. Had other politicians given Solzhenitsyn’s work the attention it deserved they might have gone easier on the people during difficult times.

Independent peasants known as “kulaks” resisted the collectivization of agriculture. During Stalin’s campaign to eliminate the kulaks as a class, as Solzhenitsyn noted, food was confiscated and even fishing in the rivers was prohibited. Jump ahead to January, 2020.

The CDC’s;Dr. Nancy Messonnier;announces that a “novel coronavirus” has arrived stateside from China and will spread across the country. Quick to proclaim a state of emergency was California governor Gavin Newsom, who considered a statewide;ban on freshwater sportfishing.

Newsom told the anglers “we are not cancelling the fishing season. We just want to delay, not deny, that season.” But he presented no scientific evidence that anglers on the state’s remote rivers and lakes posed a danger to public health.

The governor also closed nearly all beaches in southern California, including beach bathrooms, piers, promenades, and beach bike paths. In early April, 2020, police;arrested a solitary paddleboarder;near the Malibu pier. Gov. Newsom and his aides failed to show how a single person on the water posed a threat to public health. The governor also ordered many businesses, including wineries, to shut down their indoor operations, but he;exempted Napa County;from the state’s monitoring list.

That’s why the governor’s own PlumpJack Winery,;purchased with Gordon Getty, remained open. Napa County is also home to the upscale French Laundry restaurant, where Newsom and lobbyist colleagues partied sans masks, which the governor demanded for ordinary people. None of the highly;restrictive rules for private gatherings;were in force for the governor and his friends. In similar style, while many of the state’s government schools were shut, Gov. Newsom’s four children received in-person instruction at an;exclusive private school;in Sacramento County.

Across the country in New York State, elderly patients, the group most vulnerable to Covid, were forced into nursing homes where thousands perished. National Institute of Allergy and Infectious Diseases (NIAID) boss Dr. Anthony Fauci, who claimed to;represent science,;didn’t want to talk about it.

From the nursing home victims on down through school shutdowns and the ban on paddleboarding and fishing, the government pandemic regime reflected an authoritarian mindset more than any quest to keep the people safe. As Solzhenitsyn noted, the Soviet Communist Party elite enjoyed special powers and privileges, so it’s more a matter of degree than kind.

Stalin set out to eliminate the kulaks as a class and murdered millions. American President Gerald Ford tried to free Eastern Europe with his mouth. American politicians such as Gavin Newsom and Andrew Cuomo, in alliance with government bureaucrats such as Dr. Fauci, caused vast damage to the people while claiming to keep them safe. From the Red Terror to white coat supremacy, it’s all about memory against forgetting.

- Source: This article was published at The Beacon

AFP: Iranians vote on Friday to elect a new president from six candidates, including a lone reformist who hopes he can challenge the dominance of conservatives in the Islamic republic.

A presidential election had not been due until 2025, but was brought forward after ultraconservative Ebrahim Raisi died in a…

Reuters: Pakistan’s defence minister on Wednesday criticised a U.S. House of Representatives resolution calling for a probe of alleged voting irregularities in the South Asian nation’s February general election.

The vote, in which no single party won a clear majority, was marred by violence, communication blackouts and allegations by…

Gender quotas in Georgia

The advisory body of the Council of Europe, the Venice Commission, has expressed concern over the Georgian authorities’ decision to abolish gender quotas. The Commission noted that this move could impact the stability of electoral legislation.

On April 4, the Georgian parliament abolished gender quotas. The party “Girchi” initiated the removal of these quotas during the formation of electoral lists.

According to the legislative initiative by Aleksandre Rakviashvili, Iago Khvichia, Herman Sabo, and Vakhtang Megrelishvili, the change was made to the electoral code. As per the proposal, political parties will no longer be required to fill their electoral lists based on gender requirements.

On April 18, Georgian president Salome Zourabichvili vetoed the abolition of gender quotas, but the parliament overrode this veto on May 15.

Venice Commission’s conclusion

- The Venice Commission is highly concerned that the amendments were adopted hastily, without prior public consultation, and without considering the concerns raised by the president of Georgia, the Public Defender, opposition representatives, civil society, and international organizations.

- Additionally, the amendment concerning political party candidate lists affects election outcomes, and its adoption less than a year before the elections scheduled for October 2024 raises serious concerns about the stability of electoral legislation. The Venice Commission reiterates, as it has in several previous conclusions, that the practice of frequent changes to electoral legislation in Georgia threatens the integrity of the electoral process and undermines the state’s efforts to strengthen democracy.

- Essentially, the Venice Commission notes that international standards, including the Convention on the Elimination of All Forms of Discrimination Against Women (CEDAW), recognize the state’s positive obligations to ensure gender equality, as the Constitutional Court of Georgia did in its 2020 decision.

- While each country must decide how to improve gender equality in democratic institutions, including parliament, it has been proven that gender quotas can significantly impact women’s representation in parliament and do not contradict the principle of equal suffrage when enshrined in the constitution.

- Statistics show that women’s representation in Georgian politics indeed increased after the introduction of mandatory gender quotas, but more progress is needed: women’s representation in parliament rose to 19.1 percent after the 2020 elections and to 24 percent in local councils after the 2021 elections. However, this is still far from the recommended European standard of 40 percent representation of either gender in any decision-making body, political or public life.

- The 2020 changes that established gender quotas for candidates in parliamentary and local electoral lists, as well as financial incentives for political parties, aligned with the Venice Commission’s previous recommendations but have now been abolished without replacing them with other measures to facilitate the election of women candidates.

- “The Venice Commission recommends that the Georgian government adopt temporary special measures to stimulate the growth of women’s representation in parliament and local councils,” the conclusion states.

Gender quotas in Georgia