Day: June 1, 2024

Former President Donald Trump has suffered losses in three separate polls in the 48 hours since his guilty verdict in his Manhattan criminal trial.

A New York jury on Thursday found Trump, the presumptive GOP presidential nominee, guilty on 34 counts of falsifying business records relating to a hush money payment made to adult film star Stormy Daniels by Trump’s then-lawyer and fixer Michael Cohen shortly before the 2016 presidential election. Daniels alleges she had a sexual encounter with Trump in 2006, which he denies. Trump has maintained his innocence, claiming the case is politically motivated, and his lawyers plan to fight the verdict and appeal the case if necessary.

In a YouGov snap poll conducted just hours after the verdict was announced, 50 percent of the 3,040 U.S. adults who were polled said they believed Trump was guilty, while 30 percent said they believed he was not guilty. Another 19 percent said they were not sure. The poll has a margin of error of plus or minus 2.3 percent.

When broken down into party lines, 15 percent of Republicans think he is guilty while 64 percent do not, 48 percent of independents think Trump is guilty while 25 percent do not, and 86 percent of Democrats believe he is guilty while 5 percent do not. A total of 831 Republicans, 1,114 independents, and 1,113 Democrats were surveyed. The margin of error of the subgroups are unclear.

Former President Donald Trump arrives to Trump Tower on Thursday in New York City. Trump has suffered losses in three separate polls in the 48 hours since his guilty verdict in his Manhattan criminal trial.

Former President Donald Trump arrives to Trump Tower on Thursday in New York City. Trump has suffered losses in three separate polls in the 48 hours since his guilty verdict in his Manhattan criminal trial.

James Devaney/GC Images

A Morning Consult poll conducted on Friday found 54 percent of registered voters approve of the jury’s verdict while 39 percent disapprove. Across party lines, 18 percent of Republicans approve of the verdict while 74 percent disapprove, 52 percent of independents approve while 33 disapprove and 88 percent of Democrats approve while 8 percent disapprove. The poll surveyed 2,220 registered voters and had a margin of error of plus or minus 2 percentage points. The sizes and margins of error of the subsamples are also unclear.

Of the 2,220 registered voters, 51 percent said Trump should end his presidential campaign, while 43 percent said he should not. The majority of Republicans surveyed in the poll (79 percent) believe Trump should not drop out, however, 15 percent said he should. Meanwhile, 87 percent of Trump supporters don’t want him to end his campaign while 8 percent do. The margin of error for the Republican subsample is unclear.

A Reuters/Ipsos poll conducted between Thursday and Friday found that 5 percent of Republicans and 21 percent of independents said they are much less likely to vote for Trump because of the jury’s ruling. Meanwhile, 30 percent of Republicans and 13 percent of independents said the verdict made them much more likely to vote for Trump. However, the majority of Republicans (55 percent), independents (58 percent), and Democrats (58 percent) said the verdict didn’t change their minds on whether or not to vote for the former president.

The subsample of Republicans was 828 U.S. adults (with a margin of error of plus or minus 3.6 percent), independents was 708 (with a margin of error of plus or minus 4.0 percent), and Democrats was 774 (with a margin of error of plus or minus 3.7 percent).

Meanwhile, Steven Cheung, Trump’s campaign communications director, told Newsweek via email on Saturday, “President Trump has seen an outpouring support, which has led to polling increases and record-shattering fundraising numbers that include close to $53 million in just 24 hours, 30% of those who are new donors.”

He also mentioned a snap Daily Mail/J.L. Partners poll taken after Thursday’s verdict, which found that Trump’s approval rating was up by 6 percentage points compared to those who disapproved.

A total of 22 percent of likely voters had a more positive view of Trump after his guilty verdict while 16 percent had a more negative view. Meanwhile, 32 percent of likely voters who already had a negative view of Trump had no change of opinion while 27 percent of likely voters who already had a positive view of Trump had no change. The poll surveyed 403 likely voters from Thursday to Friday and had a margin of error of plus or minus 4.9 percent.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Check out this video from @PBS: PBS NewsHour, News Wrap: Netanyahu clashes with Biden over Gaza cease-fire https://t.co/JPY7qSOUES

— Michael Novakhov (@mikenov) June 1, 2024

ДнепроГЭС в критическом состоянии, заявил глава Запорожской ОВА. По словам Ивана Федорова, о производстве станцией электроэнергии речи даже не идет. Полностью перекрыто движение по плотине с левого берега на правый, специалисты изучают состояние плотины, добавил он.

За последние… pic.twitter.com/szIAWGsrHL

— DW на русском (@dw_russian) June 1, 2024

Check out this video from @PBS: PBS NewsHour, News Wrap: Netanyahu clashes with Biden over Gaza cease-fire https://t.co/JPY7qSOUES

— Michael Novakhov (@mikenov) June 1, 2024

ДнепроГЭС в критическом состоянии, заявил глава Запорожской ОВА. По словам Ивана Федорова, о производстве станцией электроэнергии речи даже не идет. Полностью перекрыто движение по плотине с левого берега на правый, специалисты изучают состояние плотины, добавил он.

За последние… pic.twitter.com/szIAWGsrHL

— DW на русском (@dw_russian) June 1, 2024

By Jayant Menon

In many ways, Cambodia is Asia’s true miracle economy. It was only three decades ago when the Paris Peace Agreements were signed, ending the civil war that ensued following the ouster of the genocidal Khmer Rouge regime in 1979. In just over a generation, Cambodia has built up its economy and institutions almost from scratch, and transformed itself into a modern, thriving economy. Although many challenges remain, these achievements should be recognised and bode well for the future.

Despite its tragic history, Cambodia has great aspirations. It aims to become an upper middle- income country by 2030 and a high-income country by 2050. To realise these aspirations, Cambodia has to pursue inclusive growth that is also sustainable and resilient. This type of growth should generate decent and sustainable jobs in the manufacturing and services sectors, and fair and sustainable returns for the self-employed, either in agriculture or in the micro, small and medium enterprises (MSMEs) across sectors, formal or informal. To do this, it has to address a number of constraints.

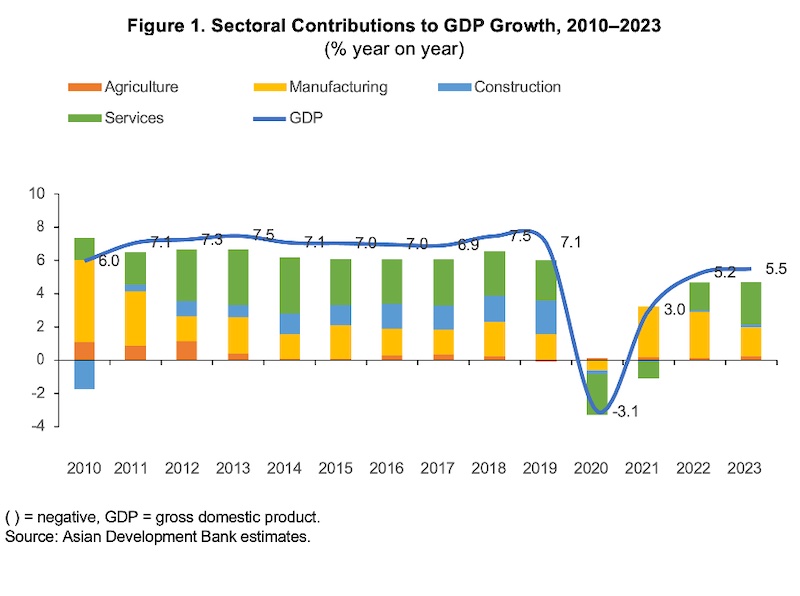

A key constraint, which is highlighted in the Royal Government of Cambodia’s Rectangular Strategy (Phase IV) and the new Pentagon Strategy Phase I, is the lack of diversification in the economy.[1] Although highlighted in the ADB’s (2014) Country Diagnostic Study (CDS), it continues to be a major constraint. The lack of diversification may not have affected the rapid pace of economic growth, but may have hindered the quality of that growth, particularly its inclusiveness and sustainability. Cambodia has been able to grow at above an annual rate of 7% since the turn of the century, except for the years afflicted by the Global Financial Crisis (GFC) and the COVID-19 pandemic (Figure 1). This high growth was mainly driven by trade preferences, tourism centred around Angkor Wat, and large capital inflows mainly from China into infrastructure and real estate. With Least Developed Country (LDC) graduation expected this decade, Cambodia will become a victim of its own success, and trade preferences and aid flows are likely to diminish. It will need to pursue new drivers of growth, which will require new and greater diversification.

The early phase of diversification or structural transformation, involving rural-urban migration from the agricultural sector into the industrial and services sector, has been ongoing but may be reaching its limit. This inter-sectoral transfer of factors of production is the easy phase of diversification, requiring minimal government intervention or policy reform, and takes place somewhat naturally with minimal disruption to factor markets (see Kaldor, 1967; Herrendorf et. al., 2013). The horizontal shift across sectors into higher value products and activities produces a one-off increase in the level of productivity, which raises incomes and living standards; however, this increase may not be sustainable.

Future increases in productivity will have to come from intra-sectoral diversification or specialisation within sectors. This involves the vertical shift into higher value-added products and activities within the industrial, services and agricultural sectors. This type of diversification is sometimes referred to as moving up the value-chain by engaging in higher value-added activities and in manufacturing, and is associated with greater participation in global value or supply chains. Unlike the early phase of industrialisation, this process of upgrading is unlikely to happen naturally and will require government intervention and/or policy reforms.

There are two major constraints that need to be addressed through policy reforms and government support to enable greater intra-sectoral diversification. The first is limited human capital and skills mismatches. Second is the high cost of doing business, which limits development of the private sector and domestic and foreign investment. Addressing these two sets of constraints should result in economic growth that is more inclusive. To ensure that these achievements are not short-lived, another set of constraints need to be addressed. This involves measures designed to increase resilience and sustainability, which would otherwise threaten current and future growth.

To address these constraints, three accompanying sets of policy reforms and government interventions are recommended.

KEY CONSTRAINTS TO DIVERSIFICATION AND INCLUSIVE GROWTH

Human Capital

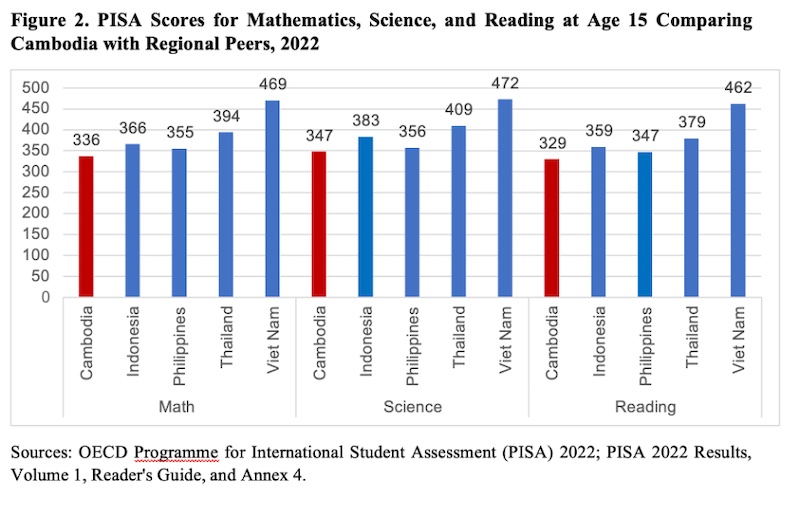

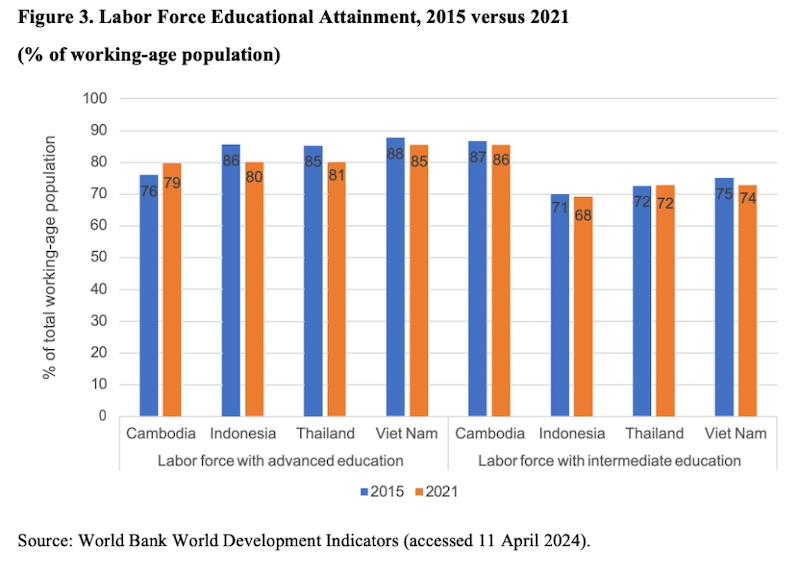

Starting with the human capital constraint, there is an urgent need to improve the quality of education at all levels, and not just Technical and Vocational Education and Training (TVET) or tertiary education. TVET and tertiary education can only succeed if students have had a strong educational foundation in primary and secondary schooling. Results from the 2022 Programme for International Student Assessment (PISA) show Cambodia lagging behind its ASEAN peers in math, science, and reading despite improvement since 2017 (Figure 2). Similarly, Cambodia lags in the share of its labour force with advanced education (Figure 3).

Quality improvements also need to be accompanied by measures to improve access and retention rates, which are currently low. For instance, Warr and Menon (2016) found that more than 30 percent of new employees in the Japanese multinational firm Denso had never attended school, could not read or write, and had limited numeracy skills. Although firms like Denso were willing to provide their own tailored and on-the-job training, these workers were effectively untrainable and could only be employed to undertake the most routine of manual tasks.[2]

Cambodia needs to invest in skills development and training in close collaboration with the private sector to avoid skills mismatches. TVET and tertiary education institutions need to align their curricula more closely with the needs of the private sector. There is also a pressing need to address the various barriers and push-and-pull factors that limit access to formal employment, and strengthen social protection systems.

Business Costs

Second is the high cost of doing business, which stems from limited physical and logistics infrastructure, high energy cost, and the high cost of finance. For a developing economy like Cambodia that is rapidly transforming, transport and related infrastructure needs are a moving target. Despite notable achievements in building infrastructure, a deficit remains which continues to add significantly to business costs. There is a need to prioritise investments both within the transport sector, as well as economy-wide. Within transport, chokepoints such as port capacity, high-cost centres such as logistics infrastructure, and inter-modal connectivity should be prioritised.

Since infrastructure development relies on foreign involvement, increasingly from China through the BRI, there is a need for better vetting of project proposals through comprehensive cost-benefit analyses conducted by an independent body. It is time for the country to consider setting-up an independent Foreign Investment Review Board, operating as a non-statutory body with inter-ministerial and multi-stakeholder representation, to assess individual proposals in a purely advisory capacity. The inter-ministerial representation would ensure that sector priorities are considered in the approval process (see Menon, 2024).

The cost of electricity in Cambodia is one of the highest in the region, with a kilowatt hour costing USD 0.14 relative to 0.11 in Thailand and 0.08 in Vietnam. The high cost is limiting vertical upgrading within electronics and automotive supply chains, from labour-intensive

assembly activities to higher value-added, energy intensive production of parts and components. Greater investment in renewable energy and energy efficiency is required to reduce costs as well as the reliance on diesel and heavy fuel oil in electricity generation. Investment in grid extension and addressing the fragmented nature of transmission and distribution will reduce the cost of electricity. There is significant potential to scale up investment in solar energy, which could significantly reduce business costs for MSMEs that are off grid.

The high cost of finance, especially to small-scale farmers and MSMEs, perpetuates poverty (Karamba et. al., 2022). Limited access to formal avenues of finance, with more than 70 percent of the population estimated to be unbanked, is closely related to its high cost. The potential for digital innovation, including fintech and blockchain, presents significant opportunities for Cambodia’s financial sector to enhance financial inclusion. Increasing digital literacy and access to digital infrastructure, which is still low in the rural sector, is required to increase access of the poor to finance at a reasonable cost.

There are also a host of long-term development challenges that need to be addressed which will affect trust in the system, and therefore both the access to and the cost of finance. These include issues relating to governance and corruption, the quality of institutions including the legal system, and the development of the finance sector and capital markets.

LONG-TERM INCLUSIVE GROWTH: INCREASING RESILIENCE AND SUSTAINABILITY

To ensure that growth is more inclusive not just in the short term but extends into the long term, there is a need to reduce the risk of disruptions while increasing the versatility in managing and responding to all kinds of shocks. Increasing resilience include addressing the impacts of: (i) climate change and other environmental pressures; (ii) financial, health and other shocks or crises; and (iii) technological change, especially the acceleration towards a digital economy. Improving the sustainability of growth and its drivers involve diversifying trade and investment flows; diversifying export products and markets and import sources, as well as sources of FDI flows, will reduce risk and increase the sustainability of economic growth. Policies and interventions to address each of these are discussed in turn, below.

Climate change and other environmental pressures

Climate change threatens the livelihoods of millions as well as long-term aspirations such as reaching high-income status by 2050. ADB (2023) estimates that Cambodia’s GDP could be up to 10% lower than otherwise in 2050.

While economic growth and environmental protection are often considered trade-offs, there can nevertheless be complementarity between them. The intersection between the two is green growth, where ecologically sustainable economic growth that fosters low carbon but socially inclusive development is the outcome. Green investments do not only unlock growth potential but also create decent and sustainable jobs for the future. There is significant potential to scale up investment in renewable energy and energy efficiency using Cambodia’s solar energy resources.[3] Significant parts of Cambodia remain without access to electricity, and solar power carries the potential of transforming remote and often poor communities by providing them with affordable clean energy and the opportunity to improve living conditions

Transitioning away from the heavy reliance on fossil fuels, reducing the rate of deforestation and adopting more sustainable agricultural and fishing practices will be critical in protecting the environment and ensuring the future prospects of these industries.

As green and sustainability aspects of production become increasingly important in business and investment decisions of international firms, reducing Cambodia’s carbon footprint would present it with new growth opportunities that arise from increasing global demand for environmentally sustainable products and services.

Financial, health, and other shocks or crises

- Financial Risks

Cambodia will need to strengthen its financial sector resilience by enhancing regulatory and supervisory frameworks, improving asset quality and risk management practices, and addressing weaknesses in the banking system. There is a need to implement regulations to deal with bank and debt restructuring, and corporate insolvency. Rising private debt following the slump in the property market has also become a concern that could threaten the stability of the economy and its future growth. The IMF (2024) notes that its share of GDP at around 160 percent is high for a country at Cambodia’s level of development.

With the growth in shadow banking and the increase in non-bank financial institutions, greater regulatory oversight and supervision will be required. Cambodia’s authorities will also need to accelerate work on a deposit protection scheme, implement measures to prevent money laundering, and clarify the framework for bank resolution.

Cambodia’s authorities will need to carefully monitor the health of banks and microfinance institutions as the forbearance measures are phased out, especially the systemically important banks that have high exposure to the construction and real-estate sector. A staged increase in minimum capital requirements could also be used to promote consolidation in the banking and microfinance sectors.

- Health crisis

Although Cambodia did remarkably well in managing the COVID-19 pandemic, it highlighted a number of vulnerabilities in the healthcare system that need to be addresses before the next health emergency occurs. Government spending on healthcare needs to be significantly increased in preparation for the next pandemic or major public health outbreak.[4] This was a major limitation in managing the COVID-19 pandemic, requiring more stringent controls than in countries with more robust healthcare systems.

There is great variation in access to quality healthcare in the urban versus rural sector. There is a pressing need to increase both the access and the quality of healthcare in remote regions, that are currently poorly served. Unless there is greater investment to increase the quality and quantity of healthcare services, any future health crisis requiring mass hospitalisation could quickly overwhelm the healthcare system, inflicting a larger than necessary human and economic toll.

- Technological change, especially the acceleration towards a digital economy

The acceleration towards a digital economy will produce many benefits, but it will also create new challenges. Many low- and medium-skilled jobs may be lost initially, although Artificial Intelligence threatens even highly skilled ones. It will not be easy to redeploy low-skilled workers, and reskilling and retraining will be required. Despite the anti-globalisation backlash elsewhere, Cambodia must remain open to importing skills and technology to help it catch up in the short run. In the long run however, the challenges posed by digitalisation and rapid technological change will require a fundamental transformation in systems of education and learning. Indeed, the digital transition reinforces the need to address the underlying problems associated with human capital and skills development discussed earlier. Augmenting cognitive skills such as math’s and sciences will be critical for the transition to a more innovative, knowledge-based economy. New and innovative approaches to public-private collaboration are also needed, particularly in areas such as research and development.

- Diversifying export markets and import sources

Cambodia’s trade patterns – both the commodity and country composition of its exports and imports – are highly concentrated, raising its vulnerability to country- or commodity-specific shocks. As the major constraints to structural diversification such as limited human capital and high business costs are addressed, trade and investment flows will also diversify. For instance, if the price of electricity could be reduced, this could attract new types of FDI from different source countries, which would result in new types of output such as electronic parts and components. This alters both the commodity and country composition of exports and imports, helping to diversify trade and investment patterns. This is one of a number of indirect channels involving policy reform that can affect trade and investment patterns. The loss of trade preferences following LDC graduation will also help diversify export products and patterns naturally.

There are specific policy changes that can be pursued to deliberately diversify trade and investment flows, and directly improve its sustainability.

Preferences are also present in the many FTAs that Cambodia is engaged in that skew the commodity and country composition of its imports. The margin of preference (MOP) — the difference between preferential and Most-Favoured-Nation (MFN) rates — is still high for many tariff lines and across different FTAs in Cambodia. When MOPs are high, trade patterns can be distorted through trade diversion. It increases concentration of trade flows by diverting them from non-FTA partners to FTA partners. Trade diversion is also welfare-reducing because imports are no longer sourced from the lowest cost producer. Pursuing open regionalism through multi-lateralisation of FTA preferences – i.e., offering preferences to all countries on an MFN basis – is in Cambodia’s national interest. It would promote domestic competitiveness and welfare, while reducing the concentration in trade patterns (see Menon, 2022).

Diversifying sources of FDI

Cambodia needs to attract FDI or incur external debt if it is to grow at a rate faster than that determined by its low domestic savings rate. There is a sustainability element associated with both FDI and debt. The need for long-term debt sustainability is widely recognised and better understood than the need to ensure that FDI inflows do not exceed absorptive capacity. The latter is associated with ensuring that external competitiveness of the tradable goods sector is not impaired by a sharp appreciation of the real exchange rate due to massive inflows of FDI, resulting in Dutch Disease-type effects.[5] The relevant point here is that an economy like Cambodia should be selective in its choice of projects, whether financed by foreign investment or borrowings, if it is to grow in a sustainable and inclusive manner. In addition, increasing the share of new investors that can help plug Cambodia into new markets and manufacturing global supply chains will support domestic structural changes by diversifying sources of growth.

CONCLUSION

Cambodia aims to become an upper middle-income country by 2030 and a high-income country by 2050. To realise these aspirations, Cambodia has to pursue inclusive growth that is also sustainable and resilient. A key constraint is the lack of diversification of the economy, which has so far not affected the rapid pace of economic growth but only the inclusiveness and sustainability of that growth. Diversification so far has involved rural-urban migration from the agricultural sector into the industrial and services sectors, but this process may be reaching its limit. The horizontal shift across sectors into higher value products and activities produces a one-off increase in the level of productivity; future increases in productivity will have to come from intra-sectoral diversification. This involves the vertical shift into higher value- added products and activities within each sector.

Two key constraints limit the extent of intra-sectoral diversification. First is inadequate human capital, requiring improvements in the quality of education at all levels, starting with primary and secondary schooling. Second is the high cost of doing business, which stems from limited physical and logistics infrastructure, high energy cost, and the high cost of finance. Addressing these constraints should increase the inclusiveness of economic growth.

To ensure that these achievements last beyond the short term, another set of constraints that affect resilience and sustainability need to be addressed. Increasing resilience includes addressing the impacts of climate and technological change, and reducing the risk of financial, health and other crises but, should they occur, also mitigating their worst impacts. Improving the sustainability of growth and its drivers involve diversifying trade and investment flows. This will reduce Cambodia’s exposure to country-specific shocks and indirectly help with diversification of the economy.

REFERENCES

ADB. 2014. Country Diagnostic Study: Cambodia, Diversifying beyond Garments and Tourism. Manila. https://www.adb.org/sites/default/files/publication/149852/cambodia-diversifying-country- diagnostic-study.pdf.

———. 2023b. Asian Development Outlook, April 2023. Manila. https://www.adb.org/publications/asian-development-outlook-april-2023.

Herrendorf, B., R. Rogerson, and Á. Valentinyi. 2013. Growth and Structural Transformation. NBER Working Paper 18996. Washington, DC: National Bureau of Economic Research. http://www.nber.org/papers/w18996

IMF. 2024. Cambodia: 2023 Article IV Consultation-Press Release; and Staff Report. 31 January. Washington, DC. https://www.imf.org/en/Publications/CR/Issues/2024/01/29/Cambodia-2023- Article-IV-Consultation-Press-Release-and-Staff-Report-544276

Kaldor, N. 1967. Strategic Factors in Economic Development, Ithaca, NY: Cornell University.

Karamba, W., K. Tong, and I. Salcher. 2022. Cambodia Poverty Assessment: Toward a More Inclusive and Resilient Cambodia. Washington, DC: World Bank. http://hdl.handle.net/10986/38344.

Menon, J. 2022. The CLMV Countries and RCEP: Will They Grasp the Opportunities? Fulcrum. 18 February. https://fulcrum.sg/the-clmv-countries-and-rcep-will-they-grasp-the-opportunities/

———. 2024. The Belt and Road Initiative in Cambodia: Costs and Benefits. Journal of Southeast Asian Economies. 41 (2), pp. 1-12. ISEAS_EWP_2023- 1_Menon.pdf.

Menon, J. and K. Naqvi. 2024. Structural Transformation and Growth Opportunities in Cambodia: A Product Space Analysis, Paper prepared for the Striving for Inclusive Economic Growth in Asia and the Pacific Conference, ADB and ADB Institute, Manila, forthcoming.

UNDP. 2019. Cambodia: Derisking Renewable Energy Investment. New York: United Nations Development Programme. https://www.undp.org/sites/g/files/zskgke326/files/2022-09/DREI%20Cambodia%20Full%20Report%20%28English%29%20%28Jun%202019%29%20%28 FINAL%29.pdf.

Warr, P. and J. Menon. 2016. Cambodia’s Special Economic Zones. Journal of Southeast Asian Economies. 33 (3), pp. 273–90. https://www.adb.org/sites/default/files/publication/175236/ewp- 459.pdf.

For endnotes, please refer to the original pdf document.

- About the author: Jayant Menon is Senior Fellow at ISEAS – Yusof Ishak Institute. He thanks Cassey Lee, Lee Poh Onn and participants at an ERDI Economics Seminar at the Economic Research Department at the ADB and the CDRI 2023 Cambodia Outlook Conference for useful comments, without implicating them in any way.

- Source: This article was published by ISEAS – Yusof Ishak Institute