“‘I find it hard to imagine how an intelligence agency would be able to maintain covert contact with somebody not only in such a high-profile position, but also a position where effectively his activities are always subject to oversight by others.’” https://t.co/FG8Hxy0I8u

— 𝙰𝚕𝚎𝚡 𝙱𝚕𝚊𝚌𝚔𝚠𝚎𝚕𝚕 (@alexrblackwell) March 10, 2024

Day: March 11, 2024

A day after the Iranian regime’s election charade, the former head of the Security Commission of the Majlis (parliament), Heshmatollah Falahatpisheh, said, “The result of the elections is a failure, not a victory.”

On March 4, the state-run Farhikhtegan newspaper made three points on the failure of the elections:

– The lowest electoral turnout in the history of the Islamic Republic signifies a crisis of legitimacy.

– The society is in the most dissatisfied political, economic, and cultural conditions.

– The cases of the 2019 and 2022 uprisings have never been resolved politically.

The three highlighted points are the same issues that regime supreme leader Ali Khamenei has focused on in recent months, and he repeatedly emphasized them only two months before the elections.

Falahatpisheh added, “Throughout the history of the revolution, not all executive and political capacities have been used to this extent. From pleas and requests to threats, the national media has been employed to urge people to participate in the ballot box.”

On February 28, Khamenei said, “If the elections are held weakly, the entire regime will suffer, and everyone will be affected. If we can show the world that the nation is present in important and decisive arenas of the country, we will save and advance the system.”

The term “saving the system” means preventing the next wave of protests and uprisings. This is because those concerned about the regime have continuously warned and expressed fear about it.

On January 1, the official IRNA News Agency quoted a regime expert as saying the following on rivalries between different regime factions: “We are in the same boat and people do not trust the entire regime, and we are part of it. For the dissatisfied and critical people on the streets, there is no differentiation between you and us. To them we are all guilty with no exception.”

In an interview with state-run Didar news website, on January 24, Journalist Ahmed Zeidabadi said, “If this situation does not change, the regime is facing a very dangerous situation, and alarm bells have been ringing for a long time.” In the same program, another government expert issued a warning, saying, “Society can no longer tolerate it. Society will not back down with imposing coercion, threats, imprisonment, and executions.”

These elections, which faced tremendous opposition from the people of Iran, were a resounding rejection of the legitimacy of the ruling regime in Iran. The resolute people of Iran are not only demonstrating their determination but also their uprising, whose footsteps are now being heard, heralding the downfall of religious fascism.

Mrs. Maryam Rajavi, the elected President of the National Council Resistance of Iran (NCRI), by referring to the determination and will of the Iranian people in boycotting the regime’s elections, said, “No doubt, Khamenei and the Velayat-e Faqih regime will come out of this theatrics, much weaker and more fragile than ever, which will expedite their overthrow. The Iranian people’s decisive ‘No’ is indicative of burgeoning uprisings, the echoes of which have already resonated across the nation, heralding the impending downfall of the clerical regime.”

By Ignacio Urbasos Arbeloa

This Policy Paper analyses the changes in the gas relationship between the EU and Russia since the invasion of Ukraine in February 2022. The analysis starts by setting out how pipeline imports have fallen by 80% due to the requirement to pay for gas in roubles, the suspension of many existing contracts and the sabotage of the Nord Stream pipelines. The reduction has had a significant impact on Gazprom’s influence over the EU, as the Russian state-owned company, which has a monopoly over pipeline exports, has lost its principal and most lucrative market and has been the object of numerous international arbitration proceedings.[1]

In contrast, and despite the sanctions, the Russian private company Novatek has successfully developed the liquefied natural gas (LNG) sector, gaining market share in the EU and maintaining deliveries since the invasion. However, there are doubts as to Novatek’s capacity to sustain its projects in a context of increased international pressure and the loss of important western commercial and technological partners, which means it is unlikely to be able to replace Gazprom in terms of volume and income, and thus does not constitute a geopolitical risk for the EU.

The main conclusions of this paper are that, while the EU has experienced a profound energy crisis, Russia has not achieved the prime objective of its gas blockade: to break the EU’s support for Ukraine. The EU has discovered that it can ensure its energy supply without depending on Moscow, and it now has to define a strategy that will establish the role of Russian natural gas in the European energy mix in the future.

The EU’s political architecture means that the impossibility of achieving unanimity among Member States will hamper its development of a joint policy and its ability to achieve the objective established in REPowerEU of ending of Russian hydrocarbon imports by 2027. Faced with stalemate in the Council of the EU, Member States must design and implement their own policies of energy diversification and uncoupling from Russia, and this will incentivise fragmentation, and, in practice, prevent a clean break in the gas relationship. It is likely that Russian gas will continue to be delivered either via pipeline or in the form of LNG to many EU Member States who decide not to impose strict measures, even after 2027. However, the volumes will be far lower than Russian exports to the EU prior to the invasion, as Russia will be competing with other suppliers (primarily North American and Qatari LNG) in a context of decarbonisation and the likely fall in demand in Europe.

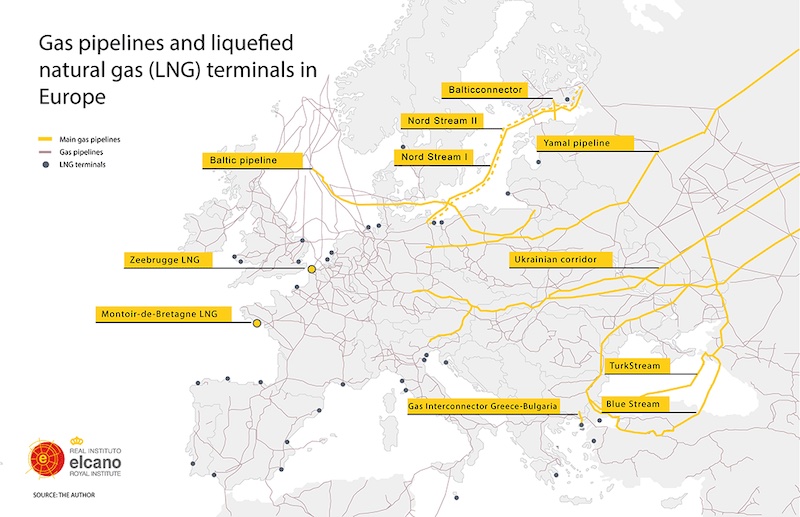

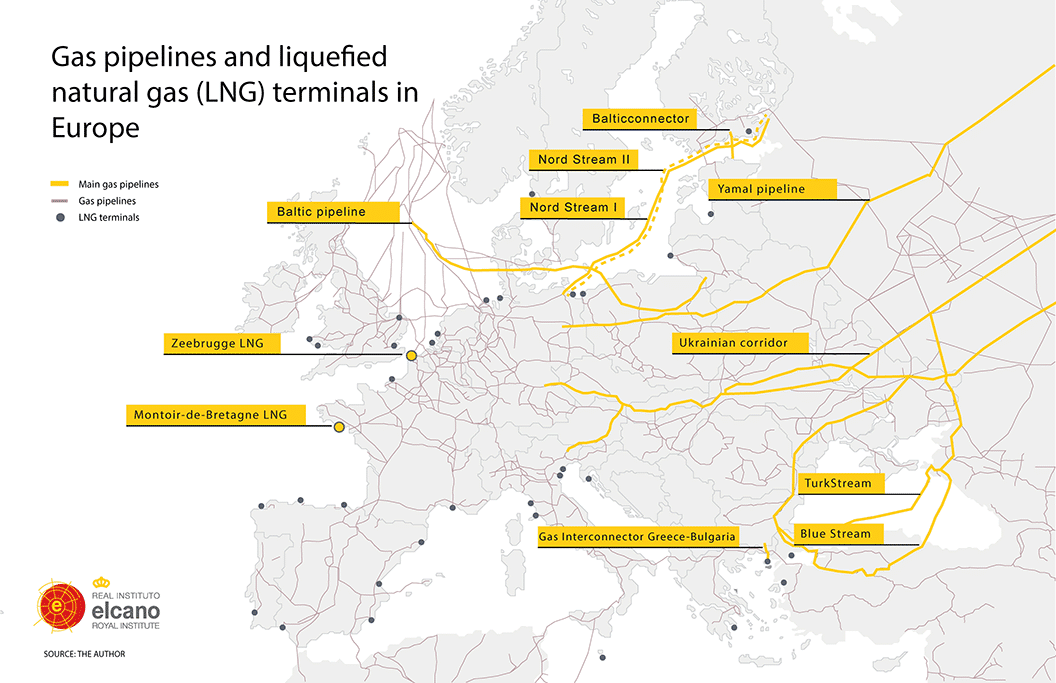

Map. Gas pipelines and liquefied natural gas (LNG) terminals in Europe. Source: the author with data from The European Space Agency

Map. Gas pipelines and liquefied natural gas (LNG) terminals in Europe. Source: the author with data from The European Space Agency

Conclusions

The EU has achieved an 80% reduction in deliveries of Russian natural gas by pipeline without having recourse to energy rationing or renouncing its political, economic and military support for Ukraine. While Russia accounted for 42% of European imports of natural gas in 2021, this percentage had fallen to 14% by 2023 (5.3% LNG and 8.7% pipeline gas). Thanks to the development of new capacities to import LNG and the construction of interconnections, the EU has entered a new phase in its decoupling from Russian gas, allaying fears of fuel shortages. The objective now is to develop a strategy to determine the future of Russian natural gas until 2027, the date established in REPowerEU for the end of the purchase of hydrocarbons from Russia.

In the case of pipeline imports, the operational return of Nord Stream can be ruled out, while for political reasons a resumption of flows via Poland (the Yamal pipeline) seems unlikely. The Ukraine transit contract will expire on 31 December 2024 and Kyiv has announced its intention not to negotiate a renewal agreement with Gazprom. Although in recent months, as part of its conversations with Hungary and Slovakia, Ukraine has opened the door to occasional deliveries of Russian gas continuing after 2024, it seems clear that these flows will be smaller than at present and would be of a provisional nature. This situation would mean that only TurkStream would be operational for deliveries of natural gas to Gazprom’s few remaining clients in the EU. TurkStream is expected to be able to absorb a marginal element of the volumes diverted from Ukraine from 2025 onwards, principally to supply Slovakia and Hungary, provoking the suspension of the remaining long-term contracts not served by Gazprom, such as those with Austria and Italy. While European countries are implementing diversification plans and remain aligned with the 2027 objective, Hungary has demonstrated its intention to continue importing Russian gas by signing new long-term contracts after the invasion. Although the position of Viktor Orbán’s government with respect to Moscow remains the exception in the EU, it sets a precedent that could undermine the will of those Member States that have the option of continuing to receive Russian gas via TurkStream.

In the case of LNG from Yamal, EU countries continue to comply with their long-term contracts while sanctions are technologically strangling Novatek’s new projects (Arctic and Murmansk) and preventing it from acquiring logistical and technological capacities. If the purchase of ice-breakers and trans-shipment services in European ports is restricted, a large part of Yamal’s production destined for Asia will face logistical difficulties during the winter, while restricting access to western technology would delay or even paralyse new projects in the Arctic. Given the growing liquidity and flexibility of the global LNG market, EU gas importers should not have any problem finding alternative suppliers to Russia, and will now be able to benefit from the new joint gas purchasing platform to negotiate these additional volumes on an aggregate basis. It will be harder to reconcile the EU’s commercial interests in Novatek projects (such as the participation of TotalEnergies, engineering and services suppliers, or utility providers with long-term contracts) with the elimination of Russian gas imports and the implementation of sanctions on LNG and the associated value chain.

Any decision to impose sanctions requires the unanimity of Member States in the Council of the EU. The capacity to achieve such consensus in Brussels with respect to sanctions on Russia has clearly weakened in recent months, due to the Hungarian veto in particular but also because of the stagnation of the conflict. This blockage has given rise to a new phase in European energy policy towards Russia, in which binding decisions will depend on the willingness of each individual Member State. In this scenario of ‘soft rules’ it is likely that Gazprom and Novatek will seek to exploit potential European divisions, offering beneficial conditions to those buyers who decline to go along with the Commission’s calls, in practice limiting the possibility of completely ending the gas relationship by 2027.

Despite this fragmentation at the EU policy level, Russian gas will play an increasingly marginal role in Europe, competing with other suppliers (primarily LNG from the US and Qatar) in a context of decarbonisation and with demand forecast to fall. In conclusion, then, Russia’s gas blockade has failed, sacrificing the country’s most lucrative energy market without breaking European support for Ukraine.

- About the author:

- Source: This article was published by Elcano Royal Institute

Notes:

Executive summary

This Policy Paper analyses the changes in the gas relationship between the EU and Russia since the invasion of Ukraine in February 2022. The analysis starts by setting out how pipeline imports have fallen by 80% due to the requirement to pay for gas in roubles, the suspension of many existing contracts and the sabotage of the Nord Stream pipelines. The reduction has had a significant impact on Gazprom’s influence over the EU, as the Russian state-owned company, which has a monopoly over pipeline exports, has lost its principal and most lucrative market and has been the object of numerous international arbitration proceedings.[1]

In contrast, and despite the sanctions, the Russian private company Novatek has successfully developed the liquefied natural gas (LNG) sector, gaining market share in the EU and maintaining deliveries since the invasion. However, there are doubts as to Novatek’s capacity to sustain its projects in a context of increased international pressure and the loss of important western commercial and technological partners, which means it is unlikely to be able to replace Gazprom in terms of volume and income, and thus does not constitute a geopolitical risk for the EU.

The main conclusions of this paper are that, while the EU has experienced a profound energy crisis, Russia has not achieved the prime objective of its gas blockade: to break the EU’s support for Ukraine. The EU has discovered that it can ensure its energy supply without depending on Moscow, and it now has to define a strategy that will establish the role of Russian natural gas in the European energy mix in the future.

The EU’s political architecture means that the impossibility of achieving unanimity among Member States will hamper its development of a joint policy and its ability to achieve the objective established in REPowerEU of ending of Russian hydrocarbon imports by 2027. Faced with stalemate in the Council of the EU, Member States must design and implement their own policies of energy diversification and uncoupling from Russia, and this will incentivise fragmentation, and, in practice, prevent a clean break in the gas relationship. It is likely that Russian gas will continue to be delivered either via pipeline or in the form of LNG to many EU Member States who decide not to impose strict measures, even after 2027. However, the volumes will be far lower than Russian exports to the EU prior to the invasion, as Russia will be competing with other suppliers (primarily North American and Qatari LNG) in a context of decarbonisation and the likely fall in demand in Europe.

Map. Gas pipelines and liquefied natural gas (LNG) terminals in Europe. Source: the author with data from The European Space Agency

Map. Gas pipelines and liquefied natural gas (LNG) terminals in Europe. Source: the author with data from The European Space Agency

Conclusions

The EU has achieved an 80% reduction in deliveries of Russian natural gas by pipeline without having recourse to energy rationing or renouncing its political, economic and military support for Ukraine. While Russia accounted for 42% of European imports of natural gas in 2021, this percentage had fallen to 14% by 2023 (5.3% LNG and 8.7% pipeline gas). Thanks to the development of new capacities to import LNG and the construction of interconnections, the EU has entered a new phase in its decoupling from Russian gas, allaying fears of fuel shortages. The objective now is to develop a strategy to determine the future of Russian natural gas until 2027, the date established in REPowerEU for the end of the purchase of hydrocarbons from Russia.

In the case of pipeline imports, the operational return of Nord Stream can be ruled out, while for political reasons a resumption of flows via Poland (the Yamal pipeline) seems unlikely. The Ukraine transit contract will expire on 31 December 2024 and Kyiv has announced its intention not to negotiate a renewal agreement with Gazprom. Although in recent months, as part of its conversations with Hungary and Slovakia, Ukraine has opened the door to occasional deliveries of Russian gas continuing after 2024, it seems clear that these flows will be smaller than at present and would be of a provisional nature. This situation would mean that only TurkStream would be operational for deliveries of natural gas to Gazprom’s few remaining clients in the EU. TurkStream is expected to be able to absorb a marginal element of the volumes diverted from Ukraine from 2025 onwards, principally to supply Slovakia and Hungary, provoking the suspension of the remaining long-term contracts not served by Gazprom, such as those with Austria and Italy. While European countries are implementing diversification plans and remain aligned with the 2027 objective, Hungary has demonstrated its intention to continue importing Russian gas by signing new long-term contracts after the invasion. Although the position of Viktor Orbán’s government with respect to Moscow remains the exception in the EU, it sets a precedent that could undermine the will of those Member States that have the option of continuing to receive Russian gas via TurkStream.

In the case of LNG from Yamal, EU countries continue to comply with their long-term contracts while sanctions are technologically strangling Novatek’s new projects (Arctic and Murmansk) and preventing it from acquiring logistical and technological capacities. If the purchase of ice-breakers and trans-shipment services in European ports is restricted, a large part of Yamal’s production destined for Asia will face logistical difficulties during the winter, while restricting access to western technology would delay or even paralyse new projects in the Arctic. Given the growing liquidity and flexibility of the global LNG market, EU gas importers should not have any problem finding alternative suppliers to Russia, and will now be able to benefit from the new joint gas purchasing platform to negotiate these additional volumes on an aggregate basis. It will be harder to reconcile the EU’s commercial interests in Novatek projects (such as the participation of TotalEnergies, engineering and services suppliers, or utility providers with long-term contracts) with the elimination of Russian gas imports and the implementation of sanctions on LNG and the associated value chain.

Any decision to impose sanctions requires the unanimity of Member States in the Council of the EU. The capacity to achieve such consensus in Brussels with respect to sanctions on Russia has clearly weakened in recent months, due to the Hungarian veto in particular but also because of the stagnation of the conflict. This blockage has given rise to a new phase in European energy policy towards Russia, in which binding decisions will depend on the willingness of each individual Member State. In this scenario of ‘soft rules’ it is likely that Gazprom and Novatek will seek to exploit potential European divisions, offering beneficial conditions to those buyers who decline to go along with the Commission’s calls, in practice limiting the possibility of completely ending the gas relationship by 2027.

Despite this fragmentation at the EU policy level, Russian gas will play an increasingly marginal role in Europe, competing with other suppliers (primarily LNG from the US and Qatar) in a context of decarbonisation and with demand forecast to fall. In conclusion, then, Russia’s gas blockade has failed, sacrificing the country’s most lucrative energy market without breaking European support for Ukraine.

- About the author: Ignacio Urbasos Arbeloa is a Research Assistant in the Energy and Climate Programme at the Elcano Royal Institute. He holds a degree in International Relations from the University of Navarra and a master’s degree in International Energy from the Institut d’Etudes Politiques de Paris. He was part of the Energy and Climate Centre at the Institut Français de Relations Internationales (IFRI) where he developed his research on the investment strategies in the European electricity sector and energy policy in Latin America.

- Source: This article was published by Elcano Royal Institute

Note: [1] The author would like to acknowledge the contributions of Gonzalo Escribano and Luís María González Sánchez.