Day: November 27, 2023

By Raphael Parens

(FPRI) — After several weeks of tense diplomatic negotiations and saber-rattling between Niamey and Paris, President Emmanuel Macron’s government withdrew Ambassador Sylvain Itte and diplomatic staff from Niger in late September. France’s military mission plans to withdraw by the end of 2023. Niger’s junta government appears totally uninterested in a continuing security relationship with France, reflecting a lack of confidence that may have encouraged President Mohamed Bazoum’s ouster on July 6, 2023.

France’s withdrawal may spell the end of French firm Orano’s uranium project in Niger’s northeast. Orano, which Paris controls with a 90 percent share, is already pivoting towards Mongolia and other partners in Central Asia. The company, to say nothing of Paris, appears interested in pursuing new relationships in less prohibitive security environments. Macron’s recent trip to Central Asia may reflect a French pivot in energy policy and investment. Without French investment, Niger’s mines could lie dormant—or be occupied by a malicious actor.

Niger’s Junta

Niger is just the latest domino to fall in the Sahel, where coups have returned at a blistering pace. Coups have toppled governments in Mali twice, Burkina Faso, and Guinea since 2021. In Niamey, a military junta led by the Presidential Guard staged a coup against Bazoum, who is also president of the Economic Community of West African States (ECOWAS) and an ally of France and the United States, on July 26, 2023. While dispatching a general to Mali to confer with Wagner Group, the junta government has sparred with ECOWAS, with many member states closing their borders to Niger and threatening military intervention to return Bazoum to power.

France’s Nigerien Uranium Project

France relies on nuclear power as a key source of its energy production. France derives approximately 70 percent of its electricity from nuclear power. Niger was its second-largest supplier at 20 percent of French uranium imports over the past ten years, trailing only Kazakhstan at 27 percent. Orano maintains majority shares in three mines in Niger: Aïr, Akokan, and Imouraren. Only the Aïr mine operates today, while Akokan is in rehabilitation mode, and Imouraren has been shuttered because of unfavorable market conditions. Many in France fear that a junta government hostile to France could restrict its access to uranium reserves that are critical to France’s power plants. While some politicians may overstate this concern as a matter of security, these deposits are located very close to the increasingly unstable border with Mali.

Niger’s Uranium and Terrorism History

Niger’s uranium mines, particularly the Somaïr mine, have historically been targeted by al-Qaeda in the Islamic Maghreb (AQIM). In 2010, five French and two African mine employees were kidnapped in the nearby town of Arlit. In 2013, AQIM exploded a car in the mine, killing one employee. Then, in 2016, AQIM’s al-Nasser brigade claimed a rocket attack on the mine, although there were no casualties.

The competition between the Islamic State in the Greater Sahel (ISGS) and AQIM in the area, the addition of a violent mercenary force (Wagner Group) with limited leadership to the fray, and an unstable post-coup environment in Niger could create a perfect storm. Unfortunately, Niger’s uranium mines might be at the heart of that storm.

Although AQIM was the primary terrorist group in Mali and Niger prior to 2015, the founding and expansion of ISGS has occurred at breakneck speed. After the withdrawal of Operation Barkhane in 2022 and as the United Nations Multidimensional Integrated Stabilization Mission in Mali (MINUSMA) continues drawing down in Mali, both AQIM and ISGS have found new territories to exploit and contest. Fighting between Wagner-backed Malian army forces and both Tuareg separatists and AQIM in Mali has recently moved into Kidal and Gao provinces, which both border Niger. Escalation into Menaka province could have serious effects on Niger’s northwestern border near the country’s uranium mines.

Niger’s Uranium Threats Today

Escalated competition between AQIM and ISGS, not to mention Boko Haram and Tuareg separatist forces across the Sahel, could put Niger’s mines under threat. These forces are fighting Wagner Group and the national militaries of Niger, Mali, Burkina Faso, and more. Attacking the Nigerien government’s access to one of Niger’s key economic exports would be a legitimate strategy by any of these groups to target a rival actor and signal legitimacy in their own inter-jihadist power struggles.

The conditions on the ground favor jihadist offensives. Mali is currently facing a security vacuum, created by Junta President Assimi Goïta’s anti-Western agenda. The withdrawal of French and UN forces from Mali and Niger are leaving significant gaps that have been filled by AQIM and ISGS. Wagner Group’s program of executions, human rights violations, and failed counter-terror activities will continue destabilizing Mali, accelerating Malian state insecurity, and likely removing any remaining Malian border security forces with Niger. Niger’s ability to resist major jihadist offensives will likely be tested very soon.

France’s ongoing diplomatic dispute with Niger’s junta government could result in punitive action taken against French-controlled elements of the uranium mines, leaving them less guarded than before. Although the head of Orano’s mining business unit has publicly stated that Niger provides security for Orano’s mines, the capacity of such security operations is becoming less and less clear as France draws down its military support from Niger.

Although Niger’s uranium reserves do not represent a direct proliferation risk in a “dirty bomb,” jihadist control of a uranium mine would be a public relations nightmare and could feed disinformation campaigns. Uranium is prohibitively expensive to concentrate and converting it into a “weaponized” form would require many expensive and technologically prohibitive steps. It is unlikely that AQIM or ISGS would try to use access to a mine as a path toward developing a weapon. Should one of these groups try to smuggle this uranium elsewhere, they would also run into a multitude of issues. The amount of uranium needed for enrichment would likely require international shipping, and there are numerous international safeguards and treaties to prevent the illicit transshipment of nuclear materials.

Despite these limits on weaponizing Niger’s uranium mines in the traditional sense, jihadist groups could still cause significant political damage and instability. Should these mines be sabotaged, jihadist groups could cause prohibitive damage to the local environment and groundwater supplies. The optics of a terrorist group gaining access to any of these mines would provide notoriety to these groups, increase recruitment, and fuel local or even regional conflict and instability. Indeed, jihadist groups could seek to swing the narrative on uranium weaponization through disinformation campaigns, inspiring fear and panic by convincing Nigeriens that a nuclear threat could be realized. Such campaigns are tied to evolving al-Qaeda and Islamic State activities in Mali and Burkina Faso, and developments in one West African state can have ripple effects across the region.

Uranium and Niger’s Economy

Lastly, a jihadist seizure of these uranium mines could irreparably damage the Nigerien economy. Today, uranium ore makes up a whopping 75 percent of Niger’s foreign exports. Since the coup, Niger has massively increased the price of uranium, from 0.80 euro/kg ($0.88/kg) to 200 euro/kg, in an attempt to match the costs of uranium produced in other countries worldwide, particularly Canada. This tectonic shift reflects the Nigerien junta’s interest in redefining its relationship with France, which benefited from cheap uranium purchased in a former colony. Perhaps Orano’s decision to reorient much of its uranium business towards Central Asia reflects a French desire to punish Niger’s junta, which would be unsurprising after the bad blood created by France’s withdrawal in the past few months. It may also be practical—as Paris sees escalating instability occurring in Niger and disinterested security forces around the country’s mining projects. Regardless, without access to uranium profits, Niger’s government may be even more hamstrung in its effort to build new security architecture against mounting jihadist threats.

Still, France’s loss may be Europe’s gain. Other EU states may enter the picture, particularly as much of Europe attempts to disentangle itself from a dependency on Russian energy amidst the war in Ukraine. Russia continues supplying the European Union with uranium ore, and a stoppage in Niger could prevent future sanctions in the energy sector against Russia. Pivoting this energy partnership could be mutually beneficial for Niger and the European Union, as both exporters and importers face rising political instability in their respective regions. However, the challenge will be ensuring facility security in remote northern Niger and along transportation routes.

Niger’s junta government will need to consider all of these complex angles as it redefines its security architecture and export regime after forcing French military and diplomatic missions out of the country. Security and economics are intimately tied together, and any security solution will require a broad strategy that reflects the risks and benefits of the country’s uranium reserves.

The views expressed in this article are those of the author alone and do not necessarily reflect the position of the Foreign Policy Research Institute, a non-partisan organization that seeks to publish well-argued, policy-oriented articles on American foreign policy and national security priorities.

About the author: Raphael Parens is a Fellow in the Foreign Policy Research Institute’s Eurasia Program and an international security researcher focused on Europe, the Middle East, and Africa. He specializes in small armed groups and NATO modernization processes

Source: This article was published by FPRI

By Suban Kumar Chowdhury

Ever wondered why the Islamic world appears divided on the issue of Palestine? To unravel this intricate dilemma, I’ve integrated three levels of foreign policy analysis with the constructivist perspective of international relations. The three levels involve examining internal factors such as political structures, leadership dynamics, and public sentiment, providing insights into how these elements shape a nation’s approach to foreign policy.

Additionally, considering societal factors like cultural norms, historical narratives, and shared identities helps illuminate the broader societal influence on views about Palestine within the Islamic world. Exploring the regional level, including geopolitical landscapes and power dynamics, sheds light on how interactions between nations impact foreign policy decisions related to Palestine. Integrating these three levels with the constructivist perspective, which emphasizes the role of ideas, identities, and norms, allows for a more holistic understanding. This approach helps move beyond simplistic observations to appreciate the nuanced interplay of domestic considerations, societal norms, and regional dynamics that collectively shape the diverse responses of Islamic nations to the Palestinian question, providing a comprehensive view of the complex forces at play in international relations.

When scrutinizing the foreign policies of Islamic nations concerning Palestine, a clear divergence emerges. Some nations passionately champion Palestinian rights and statehood, while others maintain a more reserved stance. To understand this, I delve into the domestic level of analysis, where the internal dynamics of each Islamic state shape their foreign policy. Consider Turkey, a noteworthy supporter of Palestinian rights. President Recep Tayyip Erdoğan consistently denounces Israeli actions and advocates for a two-state solution, aligning with the domestic level of analysis. Turkey’s political leadership historically shapes its foreign policy by drawing on a blend of Islamic identity, historical ties, and public sentiment. This strong advocacy for Palestinian rights is underscored by Turkey’s emphasis on Islamic identity. President Erdoğan frames Turkey’s position as a moral obligation rooted in Islamic principles, emphasizing the defense of fellow Muslims. The predominantly Muslim public sentiment in Turkey strongly aligns with the Palestinian cause, evident in mass protests and demonstrations against Israeli actions. This highlights how public opinion significantly influences Turkey’s foreign policy decisions.

On the flip side, Saudi Arabia takes a more careful and calculated approach. Even though they say they support the Palestinians, the Saudi government actually has diplomatic ties with Israel, especially when it comes to regional security. This practical approach makes sense when you look at what’s going on internally. Leaders in Saudi Arabia have to juggle the demand for Palestinian support with the real-world complexities of the region. The evidence for this lies within the Kingdom’s diplomatic relations. Despite publicly supporting Palestine, Saudi Arabia has engaged in talks with Israel on regional security matters. This kind of diplomatic engagement wouldn’t happen unless there was a careful balancing act going on behind the scenes.

Iran’s foreign policy on Palestine is deeply intertwined with both geopolitical ambitions and religious solidarity. Iran strongly supports the Palestinian cause, providing both material and political backing to groups like Hamas. At the domestic level, Iranian public sentiment, which has historically favored the Palestinian cause, significantly shapes the country’s foreign policy. This sentiment plays a crucial role in determining the government’s stance, allowing it to foster religious solidarity and highlight its dedication to a broader Islamic cause, deflecting attention from domestic challenges.

On the domestic political front, Iranian leaders, including the Supreme Leader and the President, align their foreign policy with revolutionary ideologies. The narrative of resistance against Israel becomes a cornerstone of Iranian identity, influencing the country’s foreign policy. This domestic political stance, rooted in revolutionary principles, reinforces Iran’s unwavering support for Palestine, a critical factor in shaping the country’s international stance. Iran’s alignment with the Palestinian cause serves its domestic interests. Substantial financial and military support to groups like Hamas, actively involved in the Palestinian resistance against Israel, lends evidence to this claim. Additionally, Iranian leaders consistently underscore the duty of standing against Israel as a religious obligation, fostering a sense of religious solidarity among the Iranian population. This narrative strategically diverts attention from domestic challenges, portraying Iran as a champion of a broader Islamic cause and consolidating public support.

Moving to the societal level, Turkey’s foreign policy is deeply influenced by a strong sense of Muslim solidarity, emphasizing shared Islamic values and a historical connection to the Ottoman Empire’s regional influence. President Recep Tayyip Erdoğan’s statements consistently highlight Turkey’s commitment to the Palestinian cause as a moral obligation rooted in Islamic principles, reinforcing the constructivist understanding of its role in the Islamic world. Building on this constructivist perspective, Alexander Wendt, a prominent constructivist scholar, argues that state behavior is shaped by shared ideas and identities. In the case of Turkey, the shared Islamic values and historical narratives contribute to a collective identity that guides its foreign policy choices. Erdoğan’s rhetoric aligns with this constructivist approach, as he frames Turkey’s support for Palestine as not just a political stance but a reflection of its identity and historical ties. In a similar vein, Saudi Arabia’s constructivist perspective is rooted in its custodianship of Islam’s two holiest sites. Leaders such as King Salman and Crown Prince Mohammed bin Salman express a commitment to Islamic unity, emphasizing a constructivist lens that shapes their approach to the Palestine issue. Wendt’s constructivist theory reinforces the idea that the Saudi commitment to Islamic unity, intertwined with regional dynamics, goes beyond a mere political strategy, becoming a part of its collective identity. Iran’s constructivist viewpoint, shaped by its revolutionary ideology and the concept of an Islamic Republic, is strengthened when considering the statements of its leaders, including Supreme Leader Ayatollah Ali Khamenei and President Ebrahim Raisi. Their emphasis on the religious duty of resistance against Israel aligns with the constructivist narrative. Wendt’s theory further supports the notion that Iran’s foreign policy is not solely driven by geopolitical considerations but is deeply embedded in its identity and revolutionary ideals.

On the regional stage, the constructivist lens gains further depth when examined through Alexander Wendt’s perspective. While Turkey, Saudi Arabia, and Iran’s foreign policies appear driven by geopolitical considerations, the constructivist framework highlights the importance of shared beliefs and identities in shaping state behavior. In Turkey, President Recep Tayyip Erdoğan’s statements position the country not only as a geopolitical player but as a leader in the Muslim world through championing Palestinian rights. Wendt’s constructivist argument emphasizes that anarchy is what states make of it, and in this case, Turkey actively shapes its regional role based on its Islamic identity and historical ties. Erdoğan’s vision aligns with Turkey’s historical role and influence, emphasizing a geopolitical dimension intertwined with a constructivist understanding of its leadership status in the Muslim world. Saudi Arabia’s realist perspective, as evidenced by statements from Crown Prince Mohammed bin Salman, acknowledges the strategic alliances and partnerships in the region. However, applying Wendt’s constructivist framework adds another layer. Saudi Arabia’s custodianship of Islam’s two holiest sites isn’t just a geopolitical consideration but a constructivist one, deeply rooted in religious identity. The pragmatic nature of Saudi foreign policy is, in part, a response to regional geopolitical realities, but it’s also shaped by a constructivist understanding of Islamic unity. In Iran, Supreme Leader Ayatollah Ali Khamenei and President Ebrahim Raisi’s statements framing Iran’s involvement in the conflict as part of a broader geopolitical strategy align with the constructivist lens. Wendt’s argument that identities and ideas matter in international relations is evident here. Iran isn’t solely responding to an anarchic international system; it actively constructs its role based on a revolutionary ideology and a commitment to a broader Islamic cause.

Bringing these three levels of analysis together from a constructivist lens, I find that the Islamic world’s dilemma on Palestine is a result of multifaceted influences. It’s not a simple case of unanimous agreement or disagreement. Rather, it’s a dynamic interplay of domestic considerations, societal norms, and regional dynamics that shape the responses of Islamic nations to the Palestinian question. Thus, an understanding of why the Islamic world appears divided on Palestine requires us to go beyond surface-level observations. By integrating the three levels of analysis and embracing the constructivist perspective, we can gain insights into the intricate web of factors influencing foreign policy decisions. This journey through the complexities of the Islamic world’s dilemma invites us to appreciate the nuanced nature of international relations and the diverse forces shaping geopolitical realities.

This article was published by Geopolitical Monitor.com

By Almaz Kumenov

(Eurasianet) — Kazakhstan’s National Bank has issued a digital analogue to the national currency, the tenge, as part of a stated attempt to streamline everyday financial transactions and reduce corruption.

Speaking at a press event on November 21, National Bank deputy chairman Berik Sholpankulov described the Digital Tenge, or DT, as “a new payment tool that meets the realities and challenges of the digital innovative economy.”

While sharing some features with cryptocurrencies, DT is distinct in important ways. Most notably, it is centrally issued by the National Bank rather than circulating within an open and unregulated blockchain network.

Binur Zhalenov, head of the National Payment Corporation, a subsidiary of the National Bank that is responsible for development of DT, talked up the digital platform’s potential for enhancing transparency in government spending.

“Money in the budget in Digital Tenge can be marked for specific uses. After the expenditure has taken place, this marking will disappear,” Zhalenov said. “This will … ensure public and government control over budget spending.”

Zhalenov sought to head off concerns about privacy by insisting that the government would not use the platform to track the movement of personal money of the public. Holders of the currency will, meanwhile, be able to control and vet how it is being used, he said.

By way of an example, Zhalenov said parents would be able to program DTs to control their children’s spending, including by setting prohibitions on the purchase of cigarettes and alcohol.

The creator of DT say it will also be available for use in transactions when either the buyer or seller, or both, are offline. This is a particularly appealing option in areas of the country where mobile signals are weak to non-existent.

Developers of the digital currency said that they based their project on the precedent of China’s experience of implementing its digital yuan. Zhalenov, who claims to already be receiving his salary in DT, said Kazakhstan may go down the Chinese route of using biometric data, such as fingerprints, for effecting payments.

The National Bank began its efforts to roll out the digital tenge around two years ago, initially focusing on security issues. Last year, it tested the platform together with local financial institutions. The plan is to expand the present scope of the currency to include functions like cross-border transactions by 2025.

The public in Kazakhstan is already well-used to using financial technology products for even the simplest transactions. Local lender Kaspi Bank has all but cornered the market for digital transactions with its e-wallet app.

This has proven something of a headache for the taxman, though. Market retailers, for example, were at one stage able to freely dodge paying sales taxes by having buyers identify money transfers as merely “financial aid.”

Under legislation adopted in 2021, however, traders and taxi drivers, who have customarily done much of their business in the shadows, fiscally speaking, are required to split their mobile cash transfers between person and business accounts. Bank were obliged to divulge information on cash transactions to the tax authorities under that same legislation.

Notwithstanding protestations about privacy, cynics may be inclined to suspect that the digital tenge project is being designed by the authorities to give themselves another means by which to keep tabs on who is spending what, where and when.

Almaz Kumenov is an Almaty-based journalist.

By John Klar

A controversial initiative by the Biden Administration proposes to permit the importation into the US of fresh beef from Paraguay. Many industry stakeholders protest that this will expose American agriculture to the risks of foot-and-mouth disease, with potentially devastating socioeconomic consequences. Climate warriors increasingly target cows as destructive, and now Biden risks the entire US cow (and pig) industries to improve diplomatic relations with corrupt Paraguay. The economic risks are mammoth.

As the COVID pandemic illustrated, pathogens do not abide by governmental regulations and easily transcend porous borders. Foot-and-mouth disease (FMD) is generally non-fatal to humans but is absolutely devastating to livestock – especially pigs and cows, which are more vulnerable. Yet the US Department of Agriculture’s Animal and Plant Health Inspection Service (APHIS) under Joe Biden has finalized regulations to open US markets to Paraguayan beef imports despite that nation’s history of FMD and rampant corruption.

American Farmers United

American farming industry interests are unanimously up in arms against this plan, claiming there is no current data on Paraguayan safety protocols, and that animals from other countries not subject to oversight will end up in Paraguay’s beef stream. The National Cattlemen’s Beef Association (NCBA) asserts “… that the conclusions drawn in the proposed rule are based on outdated information that does not adequately calculate the risk to U.S. consumers and the U.S. cattle herd. The United States Cattlemen’s Association and American Farm Bureau Federation also strongly oppose the rule change.”

Those risks are profound. A recent FMD outbreak in Indonesia suspected to have been caused by an illegal animal importation devastated that country’s economy and food supply. A 2001 outbreak in the UK cost that economy an estimated $20 billion. An outbreak in the United States would threaten the nation’s 90 million dairy and beef cows as well as its swine and other livestock industries. FMD also impacts wildlife species, yet further causing damage and complicating eradication efforts.

Foot and Mouth

The United States has not recorded a case of FMD since 1929 and has instituted rigorous prevention practices to safeguard its cattle industry. The disease begins with a high fever, and then develops into sores in the mouth and on hooves. FMD is highly contagious, requiring intensive countermeasures including vaccination and the slaughter of both infected and healthy animals. This is a disease that can wipe out whole industries overnight and promises to do so again.

The global presence in livestock of FMD is estimated to be 77%; the disease is enzootic (endemic) in South America, which is why Paraguay has struggled to control outbreaks for decades. The chief cause of outbreaks is usually illegally transported animals or inconsistent compliance with farm biosecurity measures, which makes corrupt Paraguay a particularly risky agricultural trade partner for an FMD-free mega-economy like America. One almost wonders if the seeds of a livestock crisis are being deliberately sown by recklessly importing dodgy meats against the cacophony of industry voices opposing the move.

Biden Ending Corruption?

Paraguay’s government enjoys a dubious reputation as an extremely corrupt cabal. President Biden, eager to establish himself as a foe of corruption (despite increasing scrutiny of his own conduct), has pushed hard to welcome Paraguay to the commerce table. The fear is that Biden’s crusade against foreign corruption may irrevocably corrupt the US food supply. As Foreign Policy noted last year:

“… corruption remains rampant, and government efforts to combat it continue to be underwhelming. Investigations have suffered setbacks; judicial processes have languished; transnational criminal activities in Paraguay have spiked; the Biden administration has now homed in on Paraguay to showcase its fight against global corruption.”

Trusting Paraguay to properly regulate its beef industry, prevent smuggling, and implement safety protocols is a bridge too far for US stakeholders. But it is exactly that rickety bridge onto which Joe Biden is dragging American consumers and agriculture. If the plan is to eradicate all cows, importing sketchy products from racketeers is the globalist way to go. Then Americans would have no choice but to dine on insect burgers or synthetic beef grown in labs.

If FMD infects the US biosphere, the impacts on the economy and global food supply will be swift and far-reaching. The stakes for importing Paraguayan steaks are astronomical. The gamble is simply too great.

- About the author: John Klar, National Correspondent with LibertyNation.com is an attorney, writer, pastor, and farmer.

- Source: This article was published by Liberty Nation

As a Thanksgiving present to readers, Washington Post columnist Catherine Rampell decided to tell us again how old-timers are robbing from our children with their generous Social Security and Medicare benefits. This is always a popular theme at the WaPo, especially around the holiday season.

The story is infuriating for four reasons:

1. Even by the calculations highlighted in the piece, Social Security is not a big subsidy to retirees,

2. Medicare appears to be a large subsidy only because our healthcare system is so inefficient,

3. What counts as a government payment, as opposed to a market outcome, is arbitrary, and

4. We pass on a whole society to our children, focusing on these programs to the neglect of the larger social and physical environment is close to absurd.

Social Security

The Social Security program has always been reasonably well-funded, even as slower growth and the upward redistribution of income over the last five decades have hurt the program’s finances. It is now projected to face a shortfall in a bit over a decade, but the gap between scheduled benefits and taxes is not exceptionally large, as calculated by Gene Steurele and Karen Smith, Rampell’s source.

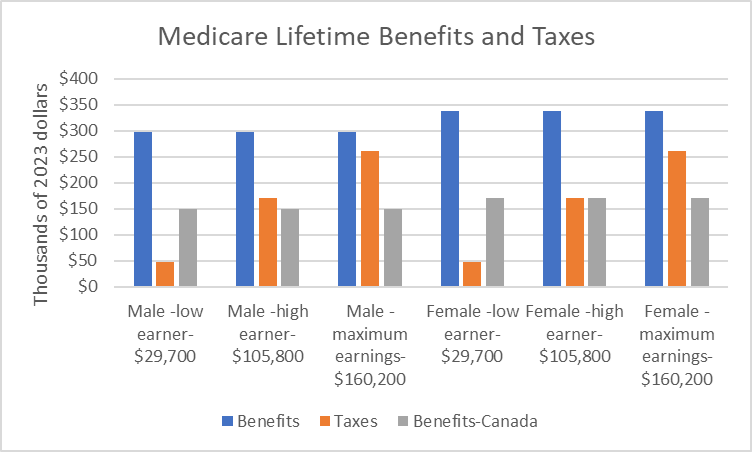

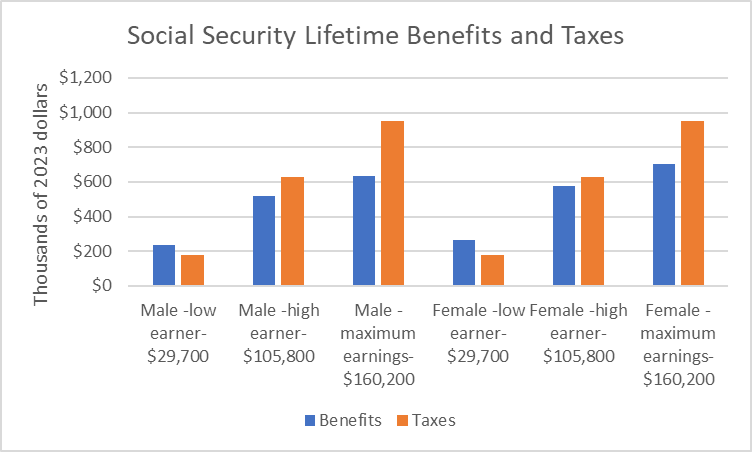

Source: Steurele and Smith, 2023.

Source: Steurele and Smith, 2023.

The chart above shows Steurele and Smith’s calculations for lifetime Social Security benefits and taxes, for people turning 65 in 2025, for men and women at different earnings levels. There are a few points worth noting on these calculations.

First, they are highly stylized, assuming that a worker puts in 43 years from age 22 to age 65 always earning the same wage relative to the overall average. This means that their wage rises year by year in step with inflation and the increase in average wages. No one actually would follow this pattern.

They are likely to earn less early in their career and more later in their career. They also are likely to have some years of little or no earnings. This is especially the case for women who are likely to spend some time outside of the paid labor force caring for children or parents. These adjustments would generally lead to higher benefits relative to taxes.

The second point is that the calculations assume that everyone lives to age 65 at which point they start to collect benefits. Some people will die before they can collect benefits, so we are looking at the benefits for workers who survive to collect benefits. (Social Security also has survivors’ benefits that go to spouses and minor children of deceased workers, so their tax payments are not necessarily a complete loss.)

The third point is that Steurele and Smith have opted to use a 2.0 percent real (inflation-adjusted) interest rate to discount taxes and benefits. This is a standard rate to use in this sort of analysis, but one could argue for a higher or lower rate. A higher rate would make the program seem less generous, while a lower rate would raise benefits relative to taxes.

As can be seen, low earners are projected to receive more in benefits than they pay in taxes. An important qualification here is that there is a large and growing gap in life expectancies between low and higher earners. These calculations assume that everyone of the same gender has the same life expectancy regardless of their income. This means that the benefits will be somewhat overstated for low earners and understated for high earners.

Ignoring the life expectancy issue, the chart shows that projected benefits end up being less than taxes once we get to high earners ($105,800 in 2023). For men projected lifetime taxes exceed benefits by $106,000. For women the gap is smaller at $49,000, reflecting their longer life expectancy.

Moving to maximum earners, people who earn the income at which the payroll tax is capped ($160,200 in 2023), the gaps become larger. In the case of men, projected lifetime taxes exceed benefits by $319,000. For women, projected lifetime taxes are $249,000 more than benefits.

There are some simple takeaways we can get from the Steurele and Smith analysis. First, for low and middle-wage earners Social Security does indeed pay out more in benefits than workers pay in taxes. However, the gap is not very large. For average earners, who got $66,100 in 2023, (not shown to keep the size of the graph manageable), the gap is $3,000 for men and $46,000 for women.

For higher income earners taxes actually exceed benefits. In the case of maximum earners, these excess payments are actually fairly large, as noted $319,000 for men and $249,000 for women.

This raises an interesting issue, if we are looking to cut benefits to reduce the “subsidy” to the elderly provided by Social Security. We can cut back benefits by a substantial percentage for low earners to bring their lifetime benefits more closely in line with their lifetime taxes, but do we really want to reduce retirement benefits for people who had average earnings of $29,700?

We can make some cuts for more middle-income workers, but someone earning $66,100 during their working lifetime was not terribly comfortable, and there is not much subsidy here to start, especially with men. When we get to higher earners, taxes already exceed benefits. We can still make cuts to their benefits, but we would not be taking back a subsidy by this calculation, we would be increasing their net overpayment to the program.

It’s also worth noting who is a high earner in this story. The high earner had annual earnings of $105,800 in 2023. President Biden promised that he would not raise taxes on couples earning less than $400,000. That puts his cutoff of $200,000 at almost twice the high earner level, and the calculation of lifetime benefits and taxes turns negative at a considerably lower income than the stylized high earner.

These calculations show that if we just take Social Security in isolation and want to reduce the subsidy implied here we either have to cut benefits for people who are not living comfortably by most standards, or we have to cut benefits for people who are not currently receiving a subsidy. We may decide that the latter is good policy, but we should be clear that it is not taking back a subsidy.

There is an important qualification to this discussion. Married couples will generally do better in these calculations than single workers. This is because the spousal benefit allows the spouse to collect the greater of their own benefit or half of their spouse’s benefit. Also, a surviving spouse will receive the greater of their own or their deceased spouse’s benefit. For these reasons, lifetime benefits for couples will generally be higher relative to taxes than for single individuals.

The Medicare Subsidy and the Broken Healthcare System Story

The Steurele and Smith analysis shows much larger subsidies for the Medicare program, as shown below.

There are a few qualifications to these calculations that should be noted. First, the same caveats about earnings patterns that were noted with the Social Security calculations also apply to the projected value of Medicare taxes.

Second, the differences in life expectancies by income matter here also when assessing the size of the tax penalty or subsidy. The program is less generous for low earners than shown in this figure and more generous for high earners.

The third point is that, unlike with the designated Social Security tax, the Medicare tax is not capped. This means that people earning above the Social Security cap will be paying more taxes to support the program. For very high earners ($185,000 for men and $207,000 for women), projected taxes would exceed benefits. The size of the tax penalty increases further up the income scale.

Finally, high-income people also pay a designated Medicare tax on capital income, like dividends and capital gains. For these people, it is virtually guaranteed that their Medicare taxes exceed their projected benefits.

With these caveats, we see the same general story as with Social Security, where there is more of a subsidy for lower earners than higher earners. While the overall gaps are larger for Medicare, projected benefits exceed taxes by a larger amount, this changes less with income than in the case of Social Security.

This is due to the fact that, unlike Social Security, the payout is not designed to be progressive, with all retirees getting in principle the same benefit.[1] This is qualified by the fact that higher-income retirees can expect to receive benefits for a considerably longer period of time, making the benefit regressive.

I have added a third bar to this graph, labeled “Benefits-Canada.” This is a calculation of what the cost of benefits would be if we paid the same amount per person for our healthcare as Canada does. The Medicare program appears as a huge subsidy to beneficiaries primarily because we pay so much more for our health care than people in other wealthy countries.

According to the OECD, we pay 57 percent more per person than Germany, 107 percent more than France, and 99 percent more than Canada. This sort of massive gap can be shown with U.S. costs relative to every other wealthy country. We don’t get any obvious benefit in terms of better healthcare outcomes from this additional spending. Life expectancy in the United States is considerably shorter than in most other wealthy countries.

The “Benefits-Canada” bar allows us to assess the value of Medicare benefits if our healthcare costs were more in line with those in other countries. It multiplies the projected value of Medicare benefits by the ratio of per person health care costs in Canada to costs in the United States (50.3 percent).

As can be seen, if we calculate Medicare benefits assuming that we pay as much for our health care as people in Canada, most of the calculated subsidy goes away. Low earners still receive a substantial subsidy, $102,000 for men and $122,000 for women, but this quickly goes away higher up the income ladder.

If we assume Canadian health care costs, a high-earning male has a net Medicare tax penalty of $21,000, while a high-earning woman has a net tax penalty of just under $1,000. For those earning at the Social Security maximum, the net tax penalty for men is $111,000, and for women it’s $91,000.

The implication of this calculation is that the seemingly large subsidies that Medicare provides to retirees is not due to the generosity of benefits, it is due to the fact that we overpay for our healthcare. Medicare is not providing a large subsidy to retirees, it is providing a large subsidy for drug companies, medical equipment suppliers, insurers, and doctors. (In case you are wondering, people in the U.S. are not generally paid much more than people in other wealthy countries. Our manufacturing workers get considerably lower pay.)

We pay roughly twice as much in all of these categories as people in other wealthy countries. It is misleading to imply that these overpayments are generous to retirees. While all of these interest groups have powerful lobbies, which makes it politically difficult to bring their compensation in line with other wealthy countries, we should at least be honest about who is getting subsidized by the high cost of our Medicare program.

What Do Subsidies Mean, When the Government Structures the Market?

There is another aspect of these calculations that should have jumped out at people when I noted that the designated Medicare tax is not capped and also applies to capital income. The taxes that are designated for these programs are arbitrary. We can designate other taxes that people pay as being Social Security and Medicare taxes, and apparent subsidies will disappear.

In fact, the idea that we can make a clear distinction between income that people have somehow earned, and income that is given to them by the government, is in fact an illusion. The government structures the markets in ways that allow some people to get very wealthy and keep others on the edge of subsistence.

Those who make big bucks in the healthcare industry are just one example. While our trade policy was quite explicitly designed to open the door to cheap manufactured goods, we actually have increased the barriers that make it difficult for foreign-trained doctors to practice in the United States.

We have made patent and copyright monopolies longer and stronger. The government subsidizes bio-medical research and then gives private companies monopoly control over the product. In a recent example, we paid Moderna to develop a COVID vaccine and then gave them control over it, creating at least five Moderna billionaires.

We have allowed our financial sector to become incredibly bloated, creating many millionaires and billionaires, even as we demand efficiency elsewhere. We give Elon Musk and Mark Zuckerberg Section 230 protectionagainst defamation suits that their counterparts in print and broadcast media do not enjoy.

And, as was recently highlighted with the UAW strike, our CEOs make far more than the CEOS of comparably sized companies in other wealthy countries. The difference is as much as a factor of ten in the case of Japanese companies. This is not due to the natural workings of the market, this is the result of a corrupt corporate governance structure that allows the CEOs to have their friends set their pay.

Yes, I am again talking about my book (it’s free). It is absurd to obsess about tax and transfer policy while ignoring the ways in which the government structures the market to determine winners and losers. It is understandable that the right would like tax and transfer policy to be the focus of public debate, since the default is a market outcome that leaves most money with the rich.

However, it is beyond absurd that people who consider themselves progressive would accept this framing. We can structure the market differently to get more equitable market outcomes. This should be front and center in public debate. Unfortunately, the right wants to hide the fact that we can structure the market differently, and progressives are all too willing to go along.

Future of the Planet

There is a final point on the sort of generational scorecard implied by these calculations of Social Security and Medicare benefits. We don’t just hand our children a tax bill, we hand them an entire economy, society, and planet.

If we experience anything resembling normal economic growth, average wages will be far higher twenty or thirty years from now than they are today. Will the typical worker see these wage gains? That will depend on distribution within generations, not between generations.

We also see costs from items like the military. When I was growing up in the 1960s we paid a much larger share of our GDP to support the Cold War. (Young men were also drafted.) We will again pay lots more money for the military if we have a new Cold War with China. The implied taxes don’t figure into the Social Security and Medicare calculations, but will be every bit as much of a drain on the income of people in the future as taxes for these programs.

And, we should always have global warming front and center. If we paid off the national debt and eliminated the programs to support retirees, but did nothing to restrain global warming, our children and grandchildren would not have much reason to thank us. First and foremost, we must give them a livable planet.

Phony Answers to a Phony Question

The whole subsidy to retiree story is a diversion from the many important issues facing the country. Even the core idea, that we don’t adequately support the young because we give too much to the elderly is wrong.

We saw this very clearly in the debate over the extension of the child tax credit. As with everything in Congress, much is determined by narrow political considerations. Republicans had no interest in giving President Biden and the Democrats a win, but the bill could have passed without Republican votes.

The deciding factor was the refusal of West Virginia Senator Joe Manchin to support the bill. Senator Manchin was very clear on his concerns. He didn’t argue that we were spending too much on retirees, he didn’t want low-income people to have the money.

This is in general the story as to why we don’t have adequate funding for early childhood education, children’s nutrition, day care and other programs that would benefit children. There is a substantial political bloc that does not want to fund these programs. And, they still would not want to fund these programs even if we didn’t pay a dime for Social Security and Medicare.

Note:

[1] This is not strictly true, since the premium payment that retirees make for Part B and Part D of the Medicare program depends on income in retirement.

This first appeared on Dean Baker’s Beat the Press blog.